“As Foreign Investors Flee and Reserves Plunge, Can India’s Currency Defy the Odds?”

Imagine a savings account, a safety net for emergencies, an assurance during turbulent times. For nations, this concept takes the form of foreign exchange reserves—a crucial asset composed of US dollars, gold, and other foreign currencies. These reserves are the financial bedrock for stabilizing economies, particularly for India. They mitigate inflation, address trade imbalances, and cushion the impacts of volatile foreign investments. Yet, a dramatic decline in India’s reserves has ignited concerns, raising questions about its implications for the economy, investors, and ordinary citizens alike.

India’s foreign exchange reserves recently plummeted by $17.8 billion in a single week, marking the sharpest weekly drop on record. Over the last seven weeks, the total depletion has amounted to a staggering $50 billion, reflecting a 7% contraction. Such a precipitous decline prompts immediate scrutiny. What lies behind this alarming trend? Why does it matter to everyday individuals and global stakeholders?

The decline primarily stems from two interconnected factors. First, foreign investors, especially Foreign Portfolio Investors (FPIs), have been withdrawing their capital from Indian markets. These investors can be likened to financial tourists, seeking high returns but quick to exit when other destinations appear more lucrative. In November alone, FPIs divested over $4 billion from India’s markets, illustrating their diminishing confidence.

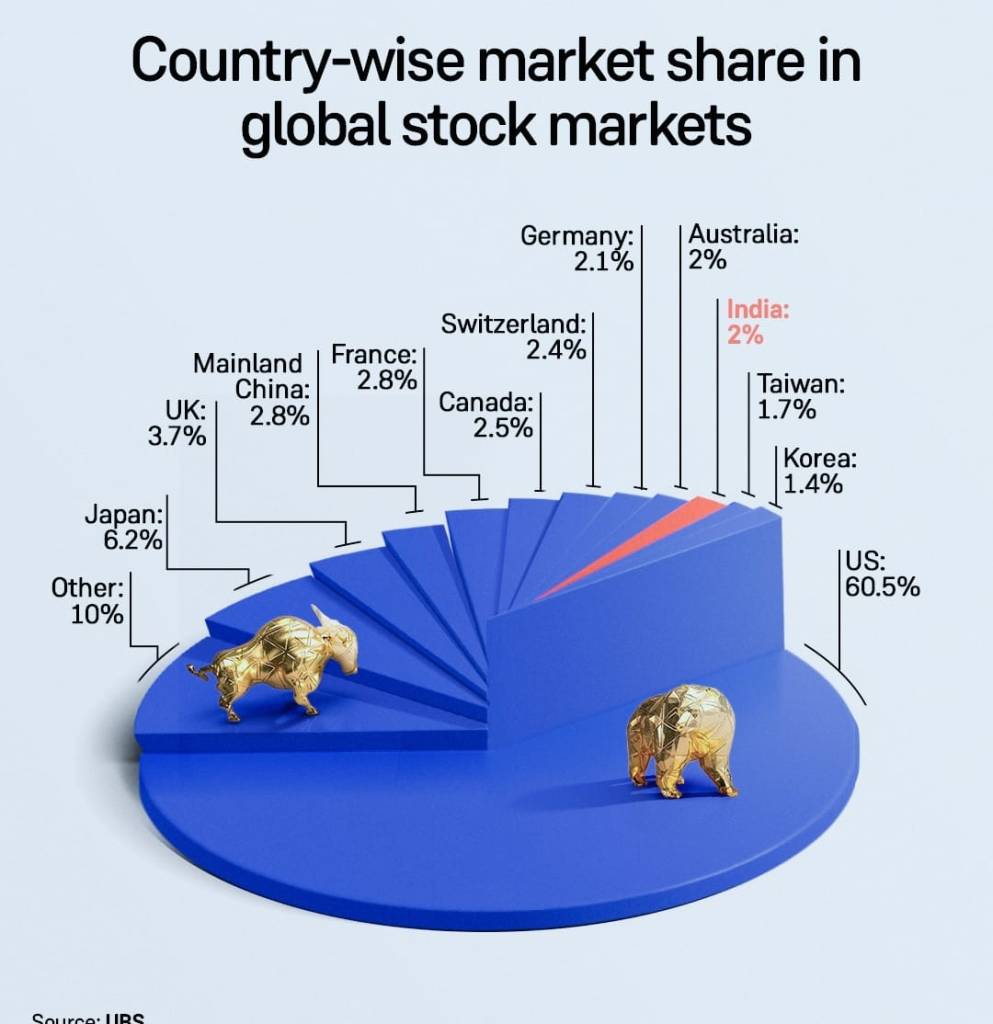

Why the sudden change in sentiment? One significant reason is China’s renewed allure. The Chinese government has recently implemented strategic economic measures, making its market more attractive to global investors. Coupled with the strengthening US dollar, these developments have drawn capital away from India. The United States, offering promising growth prospects, has become a magnet for investment. Additionally, India’s own financial landscape—characterized by sluggish corporate earnings and overvalued stocks—has done little to retain foreign capital. Investors, driven by the pursuit of optimal returns, are shifting their focus elsewhere.

The departure of foreign capital has a direct and immediate effect on India’s foreign exchange reserves. As FPIs exit, they exchange their rupees for dollars, intensifying the demand for the latter and exerting downward pressure on the rupee’s value. In a typical free-market scenario, such demand would lead to a significant depreciation of the rupee. However, this has not been the case. The Reserve Bank of India (RBI) has intervened decisively, selling dollars from its reserves to stabilize the currency. Remarkably, despite these turbulent conditions, the rupee has remained relatively stable, depreciating by less than 1% against the US dollar over the past year. In contrast, currencies like Russia’s Ruble and even the Singapore dollar have seen declines of 12% and 3%, respectively.

This proactive stabilization, however, comes with significant trade-offs. To understand the stakes, consider the consequences of allowing the rupee to float freely. A sharp depreciation would render imports—such as crude oil, electronics, and essential food items—markedly more expensive. The resulting cost escalation would drive inflation, directly impacting households and increasing the financial burden on consumers. Rising prices for fuel and everyday goods could spiral into a broader economic crisis, affecting millions.

Yet, maintaining a stable rupee is far from a simple solution. The RBI’s focus on currency stabilization limits its flexibility in addressing other economic challenges. For example, if external factors drive inflation higher, raising interest rates—a common response to curb inflation—could destabilize the currency further. This delicate balancing act underscores the complexity of economic policymaking, where short-term stability often clashes with long-term objectives.

Another critical dimension is the impact on exports. While a strong rupee benefits domestic consumers by making imports cheaper, it simultaneously hampers the competitiveness of Indian exports. For industries reliant on selling goods overseas, this poses a significant challenge. Costlier exports risk reducing demand, potentially shrinking revenues and dampening growth in export-dependent sectors. Balancing a competitive exchange rate with affordable imports is a puzzle that policymakers must solve, often under intense pressure.

Liquidity adds yet another layer of complexity. When the RBI buys US dollars to bolster reserves, it injects rupees into the economy, increasing liquidity. While this can spur economic activity, excessive liquidity risks fuelling inflation. Conversely, selling US dollars to stabilize the rupee withdraws rupees from circulation, tightening liquidity. This could slow down economic growth, presenting a trade-off between immediate stability and long-term health.

In the immediate term, the RBI’s interventions have provided a semblance of stability, shielding the economy from drastic price hikes in essential goods. Borrowing costs for consumers and businesses remain manageable, averting a broader financial crisis. However, the continued reliance on forex reserves to stabilize the rupee is unsustainable in the long run. Policymakers must navigate this turbulent phase with prudence, ensuring that short-term measures do not compromise India’s economic resilience.

The dramatic decline in India’s foreign exchange reserves is a wake-up call, highlighting vulnerabilities in an interconnected global economy. As external pressures intensify and the stakes grow higher, India’s ability to adapt will determine its trajectory. For now, the careful calibration of policies by the RBI and government remains the key to weathering this storm.

India’s foreign exchange reserves are more than a number on a balance sheet; they symbolize the nation’s economic strength and resilience. While recent declines are concerning, they also spotlight the intricate interplay of global forces and domestic policies. Stability, both in currency and confidence, requires a delicate balancing act. For a country striving for growth amid challenges, the path forward demands foresight, adaptability, and unwavering commitment to long-term goals. India’s financial journey, though fraught with hurdles, is also a testament to its resilience and potential. The world watches as India strives to turn a moment of uncertainty into an opportunity for renewal and reform.

Visit arjasrikanth.in for more insights