In the Epic Saga of Andhra Pradesh: From NTR’s Dynasty to YSR’s Legacy and Now the Manchu Family’s Ongoing Meltdown, the Struggles of Siblings in the Spotlight Unveil the Dark Underbelly of Fame and Fortune!

The Telugu film industry, affectionately known as Tollywood, has long been a crucible for stories that resonate beyond the screen itself, weaving the threads of family, fame, and fortune into a rich tapestry. Yet, few narratives encapsulate the turmoil of familial bonds quite like the ongoing saga of the Manchu family. This unfolding drama mirrors the legendary legacies of families like NTR and YSR, showcasing the complex emotional dynamics and public scrutiny that accompany wealth and influence. The Manchu family’s tale is a vivid portrayal of sibling rivalry spilling into public view, transforming private disputes into sensational spectacles that captivate audiences and fuel social media frenzy.

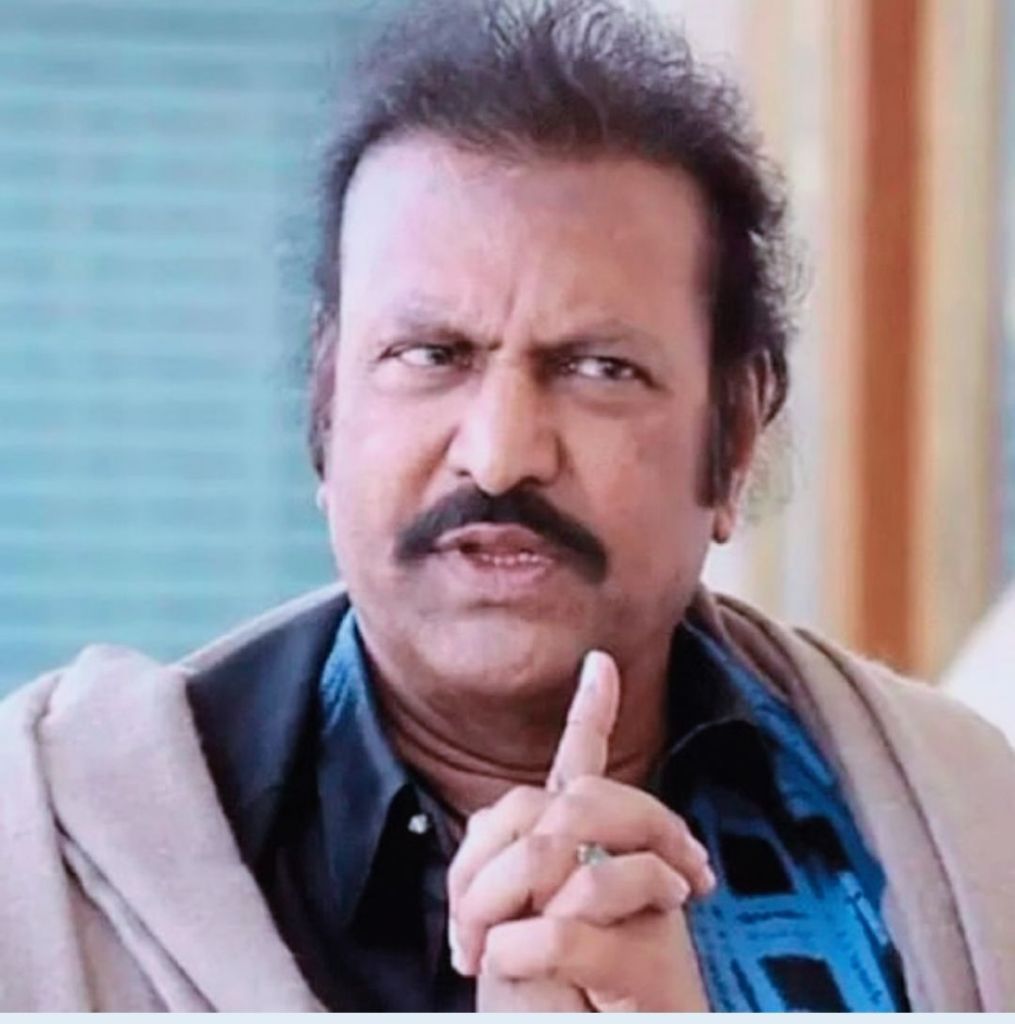

Mohan Babu, the patriarch of the Manchu family and a revered figure in the film industry, is no stranger to the limelight. With an illustrious career featuring over 500 films and a significant role in education, he has earned his place as a beloved icon. However, a recent police complaint filed against his youngest son, Manchu Manoj, and daughter-in-law, Mounika, has thrust the family into a whirlwind of controversy. Allegations of forced occupation of Mohan Babu’s Hyderabad residence have exposed cracks in a seemingly solid family foundation, revealing a rift that has been brewing beneath the surface for far too long.

The Manchu family tree is intricate, with Mohan Babu’s two marriages resulting in three children—Vishnu, Lakshmi, and Manoj—each navigating their paths in the entertainment industry. Vishnu has carved a niche as both an actor and producer, while Lakshmi has made a name for herself in both Telugu and Hindi cinema. In contrast, Manoj has struggled to find his footing, facing mounting pressures and expectations that have only intensified the familial discord. The disparities in their careers and the weight of legacy have birthed personal and financial strains, pushing the siblings into a public spectacle that is as tragic as it is compelling.

The rivalry between Manoj and Vishnu serves as a focal point in this familial saga. Their battle over finances and property has been exacerbated by Manoj’s tumultuous marriage, further isolating him from his siblings. The situation escalated dramatically when Manoj made allegations of assault against Vishnu’s associates, igniting a media frenzy that left fans and industry insiders reeling. The revelations of violence and chaos have painted a stark picture of a family once united by love and ambition, now fractured by contention and public scrutiny.

As the drama unfolds, social media becomes a double-edged sword, amplifying the family’s struggles while simultaneously scrutinizing their every move. Allegations against Vishnu regarding the misuse of funds at Mohan Babu University have added fuel to the fire, igniting debates among fans and faculty alike. The contrast between the family’s polished public persona and their internal strife starkly underscores the challenges of maintaining loyalty amidst the pressures of fame, wealth, and the unrelenting gaze of the public eye.

Lakshmi Manchu, the only daughter, has opted for a more measured approach, choosing to distance herself from the family drama while carving her identity in the competitive world of cinema. Her relocation to Mumbai for opportunities in Hindi films is both a personal journey and a statement of independence, highlighting the need for individual aspirations to flourish beyond the shadow of familial expectations.

The Manchu family’s saga serves as a microcosm of larger societal issues, reflecting themes of legacy, power dynamics, and the toll that fame can exact on personal relationships. For Mohan Babu, who dedicated his life to uplifting his family, the current turmoil is a painful reminder that even the strongest bonds can fray under the weight of ambition and pride.

As the public spectacle continues to unfold, the stakes are high for the Manchu family. Their legacy hangs in the balance amid a whirlwind of accusations and legal disputes. Industry watchers and fans alike find themselves questioning whether the siblings can reconcile their differences and restore their once-respected family image. Will they emerge from this crisis stronger, or will this chapter become a cautionary tale, chronicling the pitfalls of power and the complexities of public life?

The Manchus stand at a crossroads, attempting to navigate the turbulent waters of fame, ambition, and familial loyalty. Their current predicament serves as a poignant reminder that the allure of celebrity often comes at a steep price—one that transcends monetary wealth and delves deep into the heart of human relationships. In the grand narrative of Tollywood, the saga of the Manchu family unfolds as a vivid illustration of the intricate interplay between fame and family, revealing the often-hidden struggles that accompany their rise to prominence. As they grapple with their legacy, the Manchu family encapsulates a timeless truth: that fortune and fame, while enticing, can also lead to an unraveling of the very ties that bind us.

Visit arjasrikanth.in for more insights