When whispers of stolen ballots, phantom voters, and vanishing trust force the Election Commission to choose between guarding its pride or baring its soul.

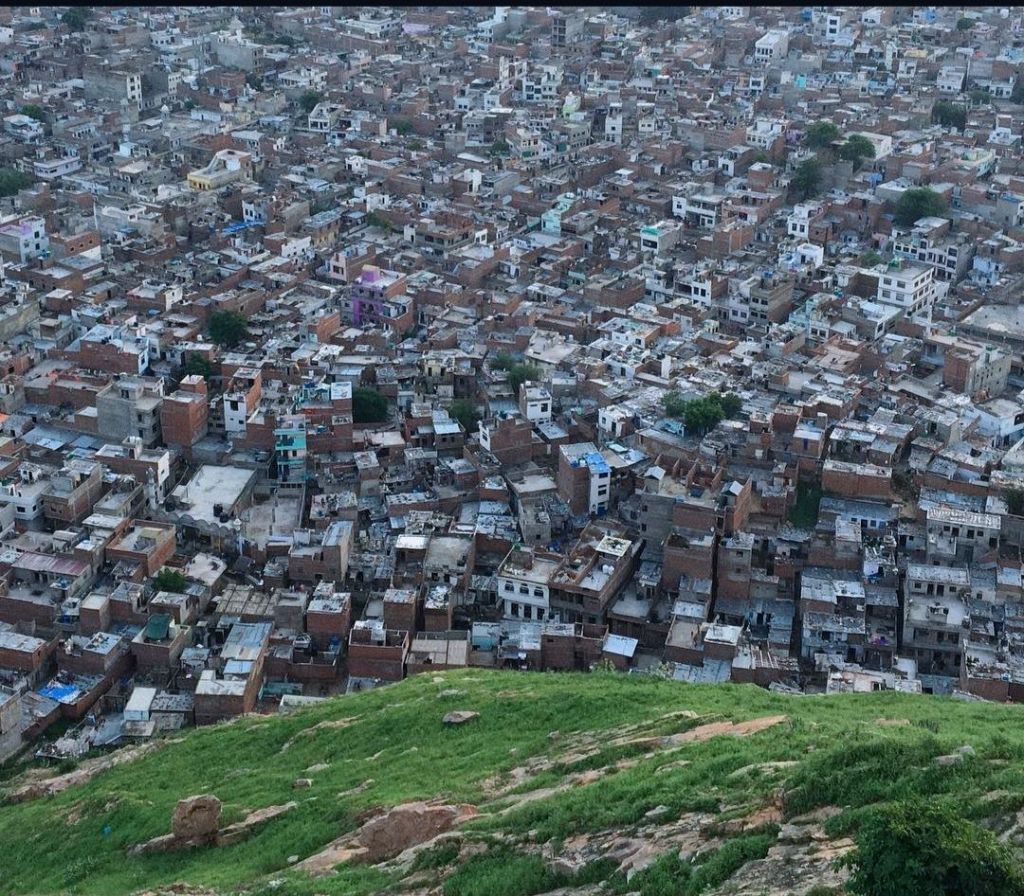

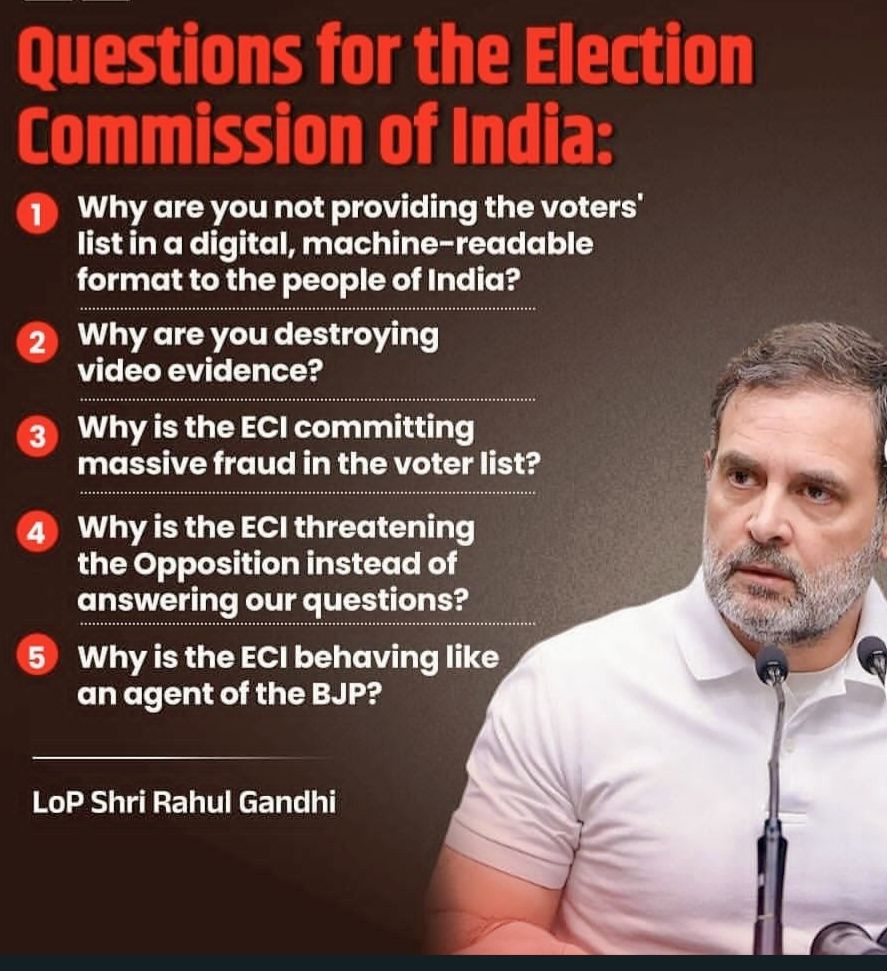

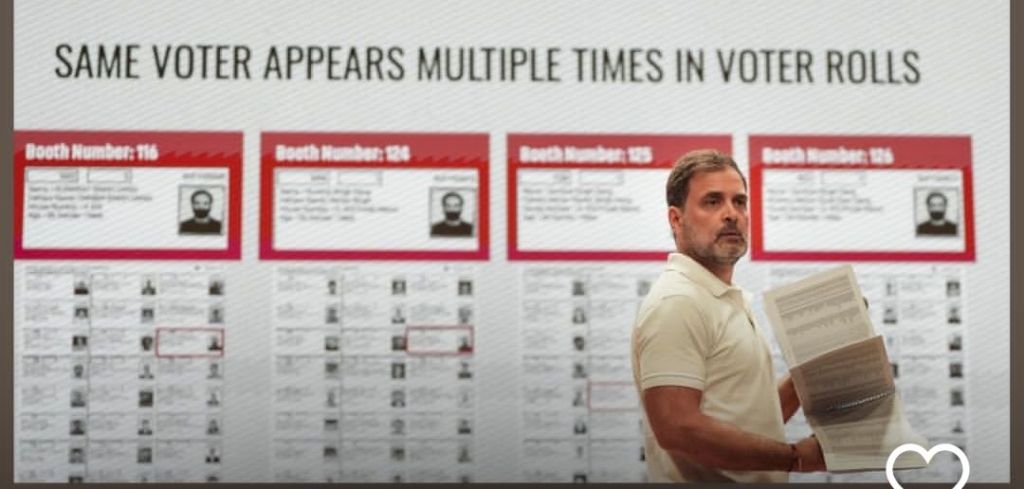

India stands at a decisive juncture where accusations, counter-accusations, and gnawing doubts about electoral integrity threaten to overshadow the very spirit of democracy. In recent weeks, the Leader of the Opposition has made startling claims — alleging large-scale manipulation of voter lists during the last general elections. The numbers cited are staggering: lakhs of duplicate entries, voters with implausible ages, suspiciously clustered addresses, bulk registrations timed to perfection, and alleged misuse of legal provisions.

In one Karnataka constituency alone, the charge is that over one lakh votes were “stolen.” If even a fraction of this proves accurate, such anomalies could have tilted results in closely fought constituencies, altering political outcomes and shaking the bedrock assumption that Indian elections are free and fair.

The framing of these allegations is not just as partisan grievance but as an assault on the Constitution itself — a breach of the citizen’s fundamental right to a transparent vote. Detailed breakdowns, purportedly drawn from voter roll analysis, are being shared to bolster the claims. Whether these withstand rigorous verification is secondary to the immediate reality: the trust that underpins the Republic is now under visible strain.

The Election Commission of India (ECI), custodian of this trust, finds itself at a defining moment. Its instinct may be to defend its systems, dismiss charges as politically motivated, and reiterate that procedures were followed. Yet in matters of democratic faith, perception often rivals proof in importance. A purely procedural defence will not suffice when public mood is restless and suspicion spreads faster than clarification.

Instead of treating the opposition leader’s statements as political theatre, the ECI has an opportunity — indeed, a duty — to respond in a scientific, methodical, and demonstrably transparent manner. That means more than a press note; it means inviting scrutiny. Release machine-readable voter roll data, allow independent audits, and explain each step of the electoral machinery in plain, accessible language.

The public should see, not be told, how voter lists are compiled, verified, and updated; how errors are flagged and corrected; and what safeguards exist to prevent systemic abuse. The Commission must also engage with the allegations point by point, answering with the calm authority of an institution that has nothing to hide.

This is not about one election alone. India’s electoral process has long been a global benchmark, lauded for its scale, reach, and perceived impartiality. That reputation will endure only if the system keeps pace with new challenges. Technology today is a double-edged sword — capable of exposing fraud but also enabling it. In such an environment, verification, auditing, and proactive public disclosure must not merely match global best practices; they must set them.

Silence or opacity will only fuel conspiracy theories, deepen political fault lines, and erode the fragile social contract on which democracy rests. Once public trust cracks, no legal reassurance can fully mend it.

For the voter, casting a ballot is not a mere formality. It is a personal reaffirmation of belonging to the nation’s shared story. When doubt creeps into that act, it corrodes civic confidence. This moment calls for leadership from the ECI — leadership marked by humility, openness, and a willingness to be questioned.

If the allegations prove baseless, an open and verifiable inquiry will clear the air, vindicating both the institution and the process. If flaws are found, admitting and fixing them will strengthen democracy rather than weaken it. In either case, the outcome is better than leaving the nation in a fog of suspicion.

The choice before the Commission is clear: close ranks and risk being seen as defending itself, or open the doors and be remembered for defending the people’s faith.

Democracy’s foundation is not merely the counting of votes. It is the unshakeable belief that every single one counts. That belief must not be allowed to wither under the weight of accusation and counterclaim. It must be nourished with verifiable facts, radical openness, and — above all — respect for the citizens whose trust is the ultimate prize in any election.

The ballot, after all, is not a sleight of hand. It is a covenant. And when that covenant is questioned, the only magic that works is the magic of truth in full public view.

Visit arjasrikanth.in for more insights