India’s boldest tax experiment trims GST from a seven-slab maze to a leaner 5% and 18%—offering relief for wallets, strain for some industries, and a political test of whether this ‘diet’ fuels growth or indigestion.”

Since 2017, the Goods and Services Tax has loomed large over every soap bar, refrigerator, diamond ring, and car in India. Heralded as “one nation, one tax,” it instead became “seven slabs, countless headaches.” What was supposed to simplify life turned into a labyrinth with more categories than a TV quiz show—5%, 12%, 18%, 28%, along with oddballs like 0.25% for precious stones, 3% for gold, and cess-loaded punishment boxes for “sin goods.” Businesses quickly learned that the only thing uniform about GST was confusion.

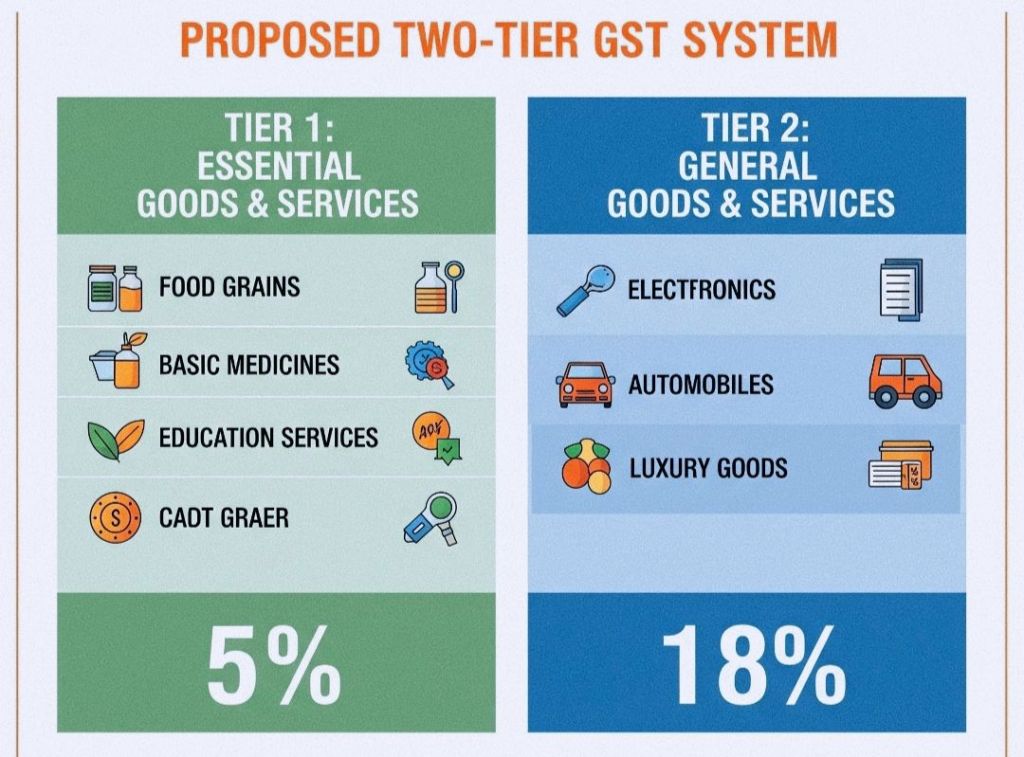

Now, the government is sharpening its scissors and proposing the biggest diet plan GST has ever seen—collapsing this buffet of rates into just a few. Most goods will fall neatly into either 5% or 18%. Diamonds and gold, perennially pampered, will retain their skinny sub-1% corner. And the naughtiest of the naughty—from tobacco to pan masala—are headed straight to the new 40% penalty box. For everything else, from toothpaste to Toyotas, relief may finally be on the way.

The numbers are not trivial. The Reserve Bank had earlier pegged India’s average GST incidence at 11.6%. Post-reform, that could sink to nearly 10.3%. It doesn’t sound like fireworks, but in a country where every paisa matters, this is seismic. Toothpaste, soap, and shampoo—the basics of everyday life—are likely to slide down to 5%. Air-conditioners and fridges, previously jailed in the 28% dungeon, may find freedom at 18%. Cars, long flogged with cess upon cess, could finally become affordable. Even cement—the backbone of housing and infrastructure, kept locked in 28% purgatory out of sheer revenue paranoia—is slated for release to 18%. That one stroke alone could turbocharge construction, jobs, and the economy’s core engines.

But no diet is without its side effects. Apparel is the obvious casualty. Today, clothes below ₹1,000 face 5%, while those above it take 12%. If the 12% slab vanishes, most garments could be bumped to 18%. For an industry already battered by export headwinds, tariff barriers, and thin margins, this would feel like a dagger. Industry associations are pleading for mercy, demanding all garments sit at 5%. Whether the Council agrees is anybody’s guess. This is the paradox of simplicity: in clearing out slabs, some industries get rescued, others get wrecked.

And then comes politics—the fine print behind every tax story. The timing of this move is no accident. The Covid-era back-to-back loans used to compensate states are nearing repayment. The special cess that cushioned states is about to legally expire. Without it, sin goods would suddenly become cheaper, and no government wants to be seen as gifting cigarettes to the masses. Enter the new 40% slab: high enough to scream “deterrence” and ensure no one mistakes fiscal housekeeping for indulgence.

Predictably, states are restless. Karnataka’s revenue minister has already cried out for “protection,” a word that echoes the original GST bargain—the Centre guaranteed states 14% revenue growth for five years. Covid smashed that promise, loans covered the cracks, but the distrust remains. The fear now is simple: if slabs shrink, so too will divisible revenues. For states, the issue isn’t whether toothpaste becomes cheaper; it’s whether their budgets will suffocate. Expect heated debates in the GST Council and the 16th Finance Commission, as states push for higher shares or fresh compensation formulas.

On the Centre’s side, the gamble is bold but shrewd. Yes, estimates say revenue losses could reach ₹1.8 lakh crore. But Delhi isn’t sweating. The RBI just transferred ₹2.69 lakh crore in surplus last year—enough to plug most of the gap. Add the belief that lower rates will spark consumption, shrink evasion, and expand compliance, and the government hopes the shortfall will be temporary. After all, if tax dodging loses its charm because rates are low, more businesses will simply pay up. Compliance by habit, not coercion—that’s the dream.

Timing is the cherry on top. Global trade is sputtering, exports are stumbling, and tariffs are rising. To keep growth alive, domestic consumption must do the heavy lifting. And what better season to ignite wallets than Diwali? Imagine Indians shopping for gold bangles, fridges, cars, and shampoos—all cheaper under a leaner GST. Call it fiscal fireworks—an economic stimulus disguised as simplification.

Yet beneath the arithmetic lies psychology. GST was supposed to be India’s proud leap into tax modernity. Instead, it earned a reputation for complexity, litigation, and compliance fatigue. Businesses saw it as a bureaucratic treadmill, not a facilitator. By collapsing slabs, the government is trying to rewrite the script: taxation as clarity, not chaos. Whether that sticks depends on political will. Will the Council hold the line on simplification, or will pressure from industries and states drag it back into the swamp of tinkering?

At its heart, this is more than a rate cut. It’s a recalibration of India’s fiscal compact—from extraction toward facilitation, from seven slabs to a handful, from bloated to lean. If the dragon of GST emerges slimmer, stronger, and more trusted, it could unleash a wave of growth and confidence. If not, we may simply end up with a new monster wearing the mask of reform.

For now, taxpayers can only watch the grand experiment unfold. Will they finally breathe easier, or will the taxman find yet another way to bite? In a system where complexity has always been the currency of control, the promise of simplicity sounds almost radical. And perhaps that’s the craziest part: in 2025, the boldest reform may simply be making GST boring.

Visit arjasrikanth.in for more insights

3 responses to “GST on a Crash Diet: From Buffet of Chaos to Two-Slab Supper ”

Nice article.

LikeLike

Awesome! Bold step.

This will definitely fuel India’s growth story & reach new heights.

Thanks Srikanth Garu for tour insights.

Sreedhar

Shreedhar_b@hotmail.com

LikeLike

Depth subject, normal people doesnt know the details.

LikeLike