From Moody’s Downgrade to Tariff Delusions, How the U.S. Is Blowing Up Its Economy While Whistling Past the Graveyard

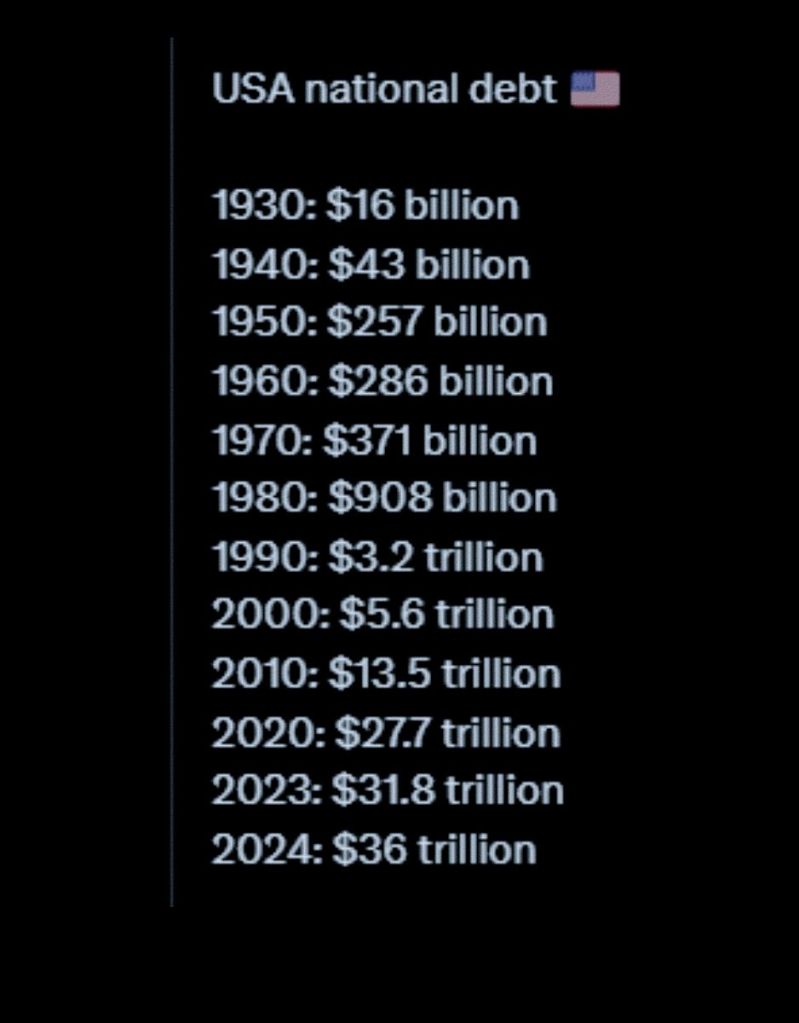

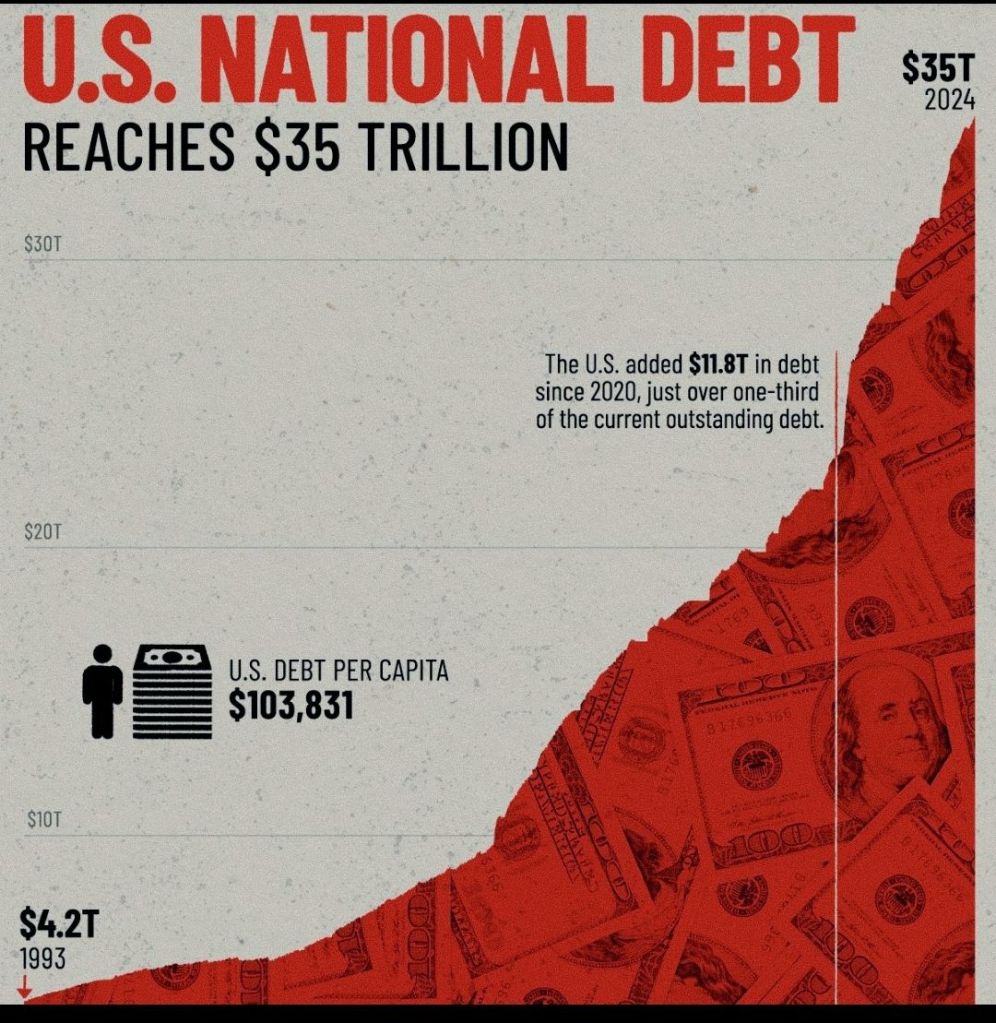

The United States is careening toward a financial abyss, and the velocity is terminal. With the national debt piercing $36.1 trillion and climbing unstoppably, every moment lost to inaction inches the country closer to a tipping point from which it may never return. What was once the world’s most powerful economic engine is now sputtering under the weight of unsustainable obligations, runaway spending, and delusional policy band-aids. Moody’s recent downgrade of America’s credit rating—from pristine Aaa to Aa1—is not just a symbolic slap on the wrist; it’s a blaring alarm bell in a house engulfed in fiscal flames.

Interest payments alone have swelled to a monstrous $882 billion annually—surpassing what the nation allocates to defend its borders or care for its sick. And these aren’t just abstract figures buried in federal ledgers; they translate into real-world losses, like the staggering $22,000 in lifetime earnings that every middle-class household stands to forfeit. Meanwhile, America’s debt-to-GDP ratio is projected to balloon to an eye-watering 200% by 2047—effectively mortgaging the nation’s future beyond recognition.

It’s not just the raw numbers that are terrifying. It’s the stubborn denialism in Washington. The so-called Fiscal Responsibility Act of 2023 was heralded as a corrective measure, but it’s nothing more than a fiscal placebo, kicking the can a little farther down a crumbling road. Emergency Treasury maneuvers are only buying time, not solutions. When these run dry by late 2025, the ceiling won’t just need to be raised—it might collapse altogether. With interest costs rising by 14% in just one year, we’re witnessing a system cracking under its own contradictions. Picture a household spending more on credit card interest than food, housing, and healthcare combined. Now scale that household to 330 million people and add nuclear weapons.

In this climate of fiscal hysteria, tariffs are being dressed up as a panacea—but this is economic cosplay at its most reckless. President Trump’s rallying cry for a 10% universal tariff, augmented by punitive 50% levies on imports from 57 countries, promises $5.2 trillion in revenue over the next decade. Sounds good—until you peel back the economic carnage hiding underneath. The Penn Wharton Budget Model estimates such tariffs would shrink GDP by 6%, lower wages by 5%, and annihilate $37 trillion in global trade by 2054. That’s equivalent to vaporizing the German economy every year, for 30 years.

And while the rhetoric of self-reliance sounds patriotic, the consequences are anything but. For every dollar collected through tariffs, the economy loses two. Inflation surges. Jobs evaporate. Innovation withers. Consumers will face sticker shock on everyday goods—from iPhones to sedans—because corporations won’t absorb the cost; they’ll pass it straight to Main Street. America is already feeling the backlash. China has retaliated with a crushing 125% tariff on U.S. agricultural goods. Canada is striking back on energy products. Mexico, once a NAFTA darling, is now being penalized with 25% tariffs on nearly all exports to the U.S.

Worse still, these protectionist policies do not occur in a vacuum. As trade dries up, tax revenues fall. As wages decline, household spending contracts. As GDP stagnates, the cost of servicing the existing debt becomes insurmountable. Ironically, the same tariffs designed to “fix” the debt problem could choke off the very growth needed to survive it. It’s the fiscal equivalent of trying to swim with cement boots—futile, foolish, and fatal.

So, what now? The exit route from this economic minefield will not be paved with short-term gimmicks or political slogans. It demands courage—of the kind not seen in Washington in decades. Entitlement reform must no longer be taboo. Social Security and Medicare now devour 75% of federal spending. Without systemic recalibration, these programs will crush the federal budget under their own weight.

Tax policy needs a radical reboot. The 2017 tax cuts, if extended, will add another $4 trillion to the deficit. If the wealthy and multinational corporations are not asked to pay their fair share, inflation will silently rob the middle class of financial security.

Blanket tariffs should be tossed into the policy dustbin. Instead, the government must opt for precision: sector-specific protections in areas critical to national security and economic competitiveness—such as semiconductors, electric vehicles, and clean tech.

Inflating away the debt might seem tempting, but it’s a game of fire. Inflation hurts retirees, erodes savings, and destabilizes investment. Hyperinflation isn’t just a word—it’s history’s wrecking ball.

Most importantly, America must grow—smartly, sustainably, and strategically. Unleashing sectors like AI, advanced manufacturing, green energy, and immigration-driven labor innovation can reboot the productivity engine. A thriving economy is the only viable antidote to a monstrous debt load.

The 10-year Treasury yield already hovers at a precarious 4.44%, hinting that the bond market—long the world’s vote of confidence in U.S. stability—is starting to sweat. If the country doesn’t course-correct soon, it could face a fate eerily reminiscent of Greece’s 2010 meltdown, with the added twist of taking the global economy down with it. The dollar’s supremacy as the world’s reserve currency is not ordained; it’s earned—and it can be lost.

The harsh truth is this: America’s debt addiction is no longer a manageable condition—it’s terminal unless radical surgery is undertaken now. Tariffs may offer a placebo high, but the crash will be catastrophic. Without deep spending cuts, responsible taxation, and laser-focused growth initiatives, this debt tsunami will obliterate everything in its path. This is not a question of if the reckoning will come—it’s a question of how devastating it will be when it does.

Visit arjasrikanth.in for more insights

One response to “America’s Fiscal Suicide: Racing Toward Ruin with a Smile”

Interesting 🤔

LikeLike