Trade Wars, Supply Chains, and Global Leverage Collide in a High-Stakes Game of Economic Chess!!

If a rupee were earned for every mention of the word “tariff” in recent weeks, one would be amassing significant wealth. The discourse around tariffs has intensified, particularly with former President Donald Trump reigniting a protectionist trade strategy many consider a high-risk approach. Far from being a historical footnote, tariffs are a recurring instrument in global economic policy—one that has evolved considerably over time. Initially introduced to protect emerging industries and raise government revenue, their role has shifted alongside the dynamics of international trade and modern economic theory.

In the early 20th century, the United States relied extensively on tariffs to shield domestic industries from foreign competition. The 1930 Smoot-Hawley Tariff Act exemplified this approach, raising tariffs by approximately 20%. The consequences were swift and severe: global retaliatory tariffs ensued, international trade plummeted, and the policy is widely regarded as having deepened the Great Depression. In the aftermath of World War II, however, the U.S. emerged as a proponent of free trade, favouring economic interdependence as a pathway to peace and prosperity. Tariffs were gradually side-lined, replaced by income tax as the principal source of government revenue.

In the contemporary global economy, the tariff debate has resurfaced with renewed vigor. To illustrate the concept, consider a local bakery facing competition from cheaper imported cupcakes. In response, the government imposes a tariff to level the playing field. While this intervention may protect domestic producers, it can also distort market dynamics, increase consumer prices, and invite retaliatory measures from affected countries.

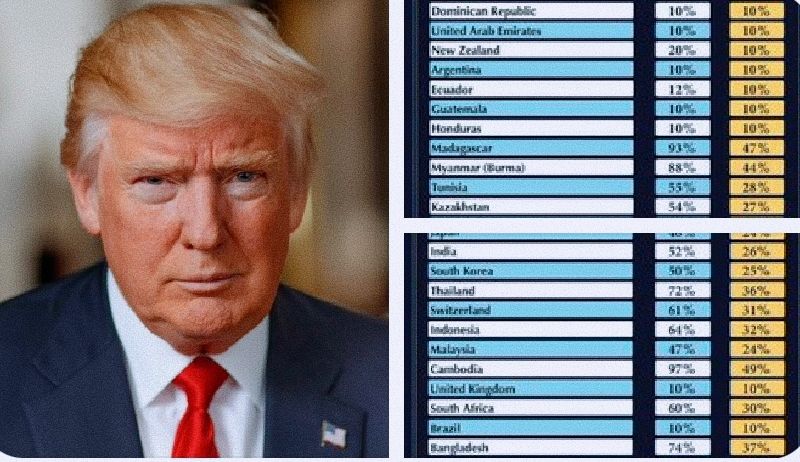

Recent U.S. actions have underscored the complexities of modern tariff policy. In April, the government announced a 100% tariff on select Chinese goods, with some rates escalating to 145%. China responded in kind, igniting a cycle of economic retaliation that has unsettled global markets. While tariffs aim to encourage domestic production and reduce reliance on foreign imports, they simultaneously raise input costs, disrupt supply chains, and burden consumers.

Supporters argue that tariffs can revitalize domestic manufacturing, preserve jobs, and enhance economic self-sufficiency. In 2019, for instance, the U.S. collected over $72 billion in tariff revenue, leading some to propose that import duties could serve as an alternative to income tax. Yet such proposals overlook the intricate fabric of global trade. Modern supply chains are deeply interconnected. A single automobile comprises nearly 30,000 components, sourced from dozens of countries. Reconstructing such supply chains domestically would not only be costly and time-consuming but could also diminish productivity and international competitiveness.

Moreover, tariffs risk straining diplomatic and economic relations. The U.S. currently faces a $295 billion trade deficit with China, a figure that underscores American dependence on Chinese imports. In turn, China’s significant holdings of U.S. Treasury bonds provide it with considerable leverage. Should Beijing choose to liquidate these holdings as a countermeasure, the impact on U.S. financial markets could be profound.

India, meanwhile, occupies a unique position in this evolving global scenario. Rather than engaging in retaliatory tariff actions, India has prioritized bilateral negotiations and multilateral trade engagements with the U.S., the U.K., and the European Union. While China mobilizes global opposition to what it deems protectionist tariffs, India’s measured response could be a strategic play—positioning itself as an attractive destination for global manufacturers seeking to diversify away from China.

However, for India to capitalize on this geopolitical shift, it must demonstrate its capacity as a reliable, competitive, and efficient manufacturing hub. Enhancing infrastructure, streamlining regulatory frameworks, and ensuring policy stability will be crucial. The current trade tensions present a rare window of opportunity, but it is one that demands swift and strategic action.

Ultimately, the renewed embrace of tariffs represents a calculated risk. While they may offer short-term advantages and political leverage, the long-term repercussions are uncertain. The interplay of economics, geopolitics, and national interests makes this a delicate balancing act. As nations recalibrate their trade policies in an increasingly volatile world, the outcomes will reverberate for decades to come. The global economy is witnessing a dramatic shift—one that requires both resilience and foresight from policymakers, industries, and citizens alike.

Visit arjasrikanth.in for more insights

One response to ““Trump’s Tariff Tango: A High-Stakes Game of Economic Roulette””

precious! 40 2025 Face-Off: Delhi’s Gaze into the Future of Policing or the Past of Surveillance? alluring

LikeLike