From GST Gains to Power Sector Pains: How India’s States Are Wrestling with Revenue, Debt, and the Fight for Sustainable Growth

When you think of state finances, what comes to mind? Perhaps it’s dense government reports brimming with jargon, a labyrinth of taxes, or the ever-elusive fiscal deficit. But behind these seemingly tedious terms lies a story that impacts every citizen profoundly—how our roads are paved, schools funded, electricity distributed, and even how healthcare systems cope with crises. State finances aren’t just about managing money; they’re about defining priorities, building resilience, and shaping the quality of life for millions.

India’s states, with their diverse economies and unique challenges, showcase the art—and struggle—of balancing revenue generation with responsible spending. With the nation emerging from the economic shockwaves of a pandemic, recent reports reveal both triumphs and trials in state financial management. The fiscal puzzle, though intricate, is essential to solving the broader question of sustainable development and equitable growth.

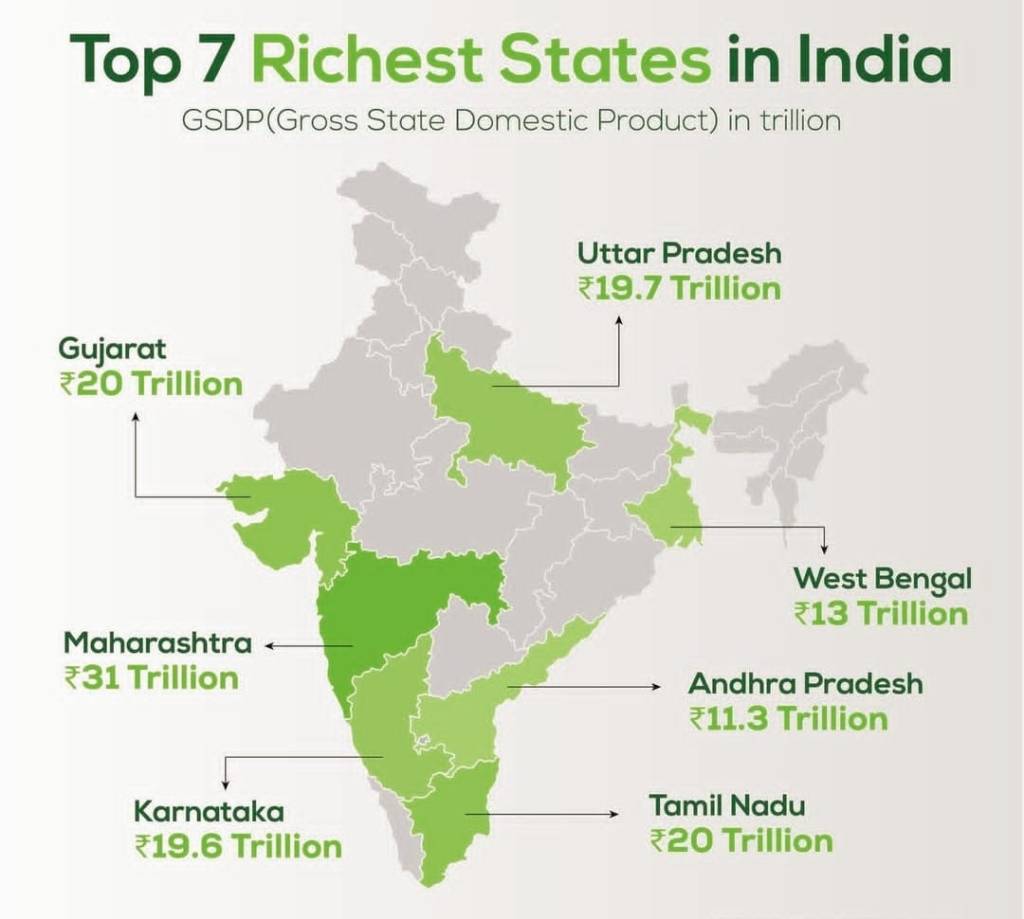

Take revenue collections, for instance. After a slump during the pandemic, states have bounced back impressively. Revenue receipts have returned to pre-pandemic levels, and debt levels have reduced, with the debt-to-GDP ratio improving from a worrying 31% in March 2021 to a more manageable 27.5% in March 2023. This is a significant milestone, signalling better fiscal discipline and enhanced efficiency. Maharashtra, with its Gross State Domestic Product (GSDP) of ₹2.89 lakh crore in 2022-23, stands as a beacon of fiscal robustness, but other states still grapple with unique challenges.

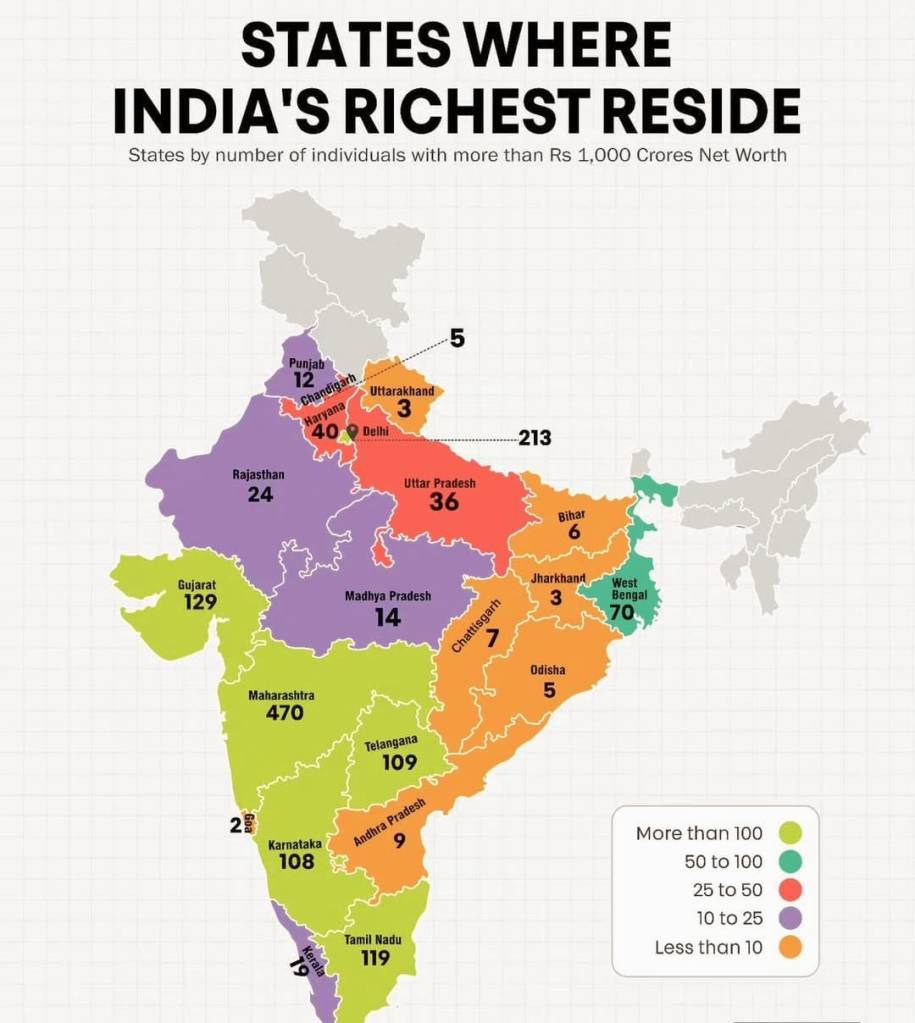

The fiscal deficit—a measure of how much more a state spends than it earns—has also shown improvement. From a staggering 4.2% in 2020-21, it dropped to 2.8% in 2021-22 and was budgeted at 3.2% for 2023-24, staying within the 15th Finance Commission’s recommended limit. This trajectory is encouraging, yet some states, like Punjab, continue to battle a high debt-to-GDP ratio. Heavy agricultural subsidies and pension commitments have left little room for investment in critical sectors like education and healthcare.

What drives state revenue? The answer lies in a mix of taxes, central transfers, and creative revenue generation. GST has been a game-changer, improving tax buoyancy and reducing disparities between states. The State Goods and Services Tax (SGST) now dominates revenue sources, a testament to the efficiency of this unified tax system. But while GST collections have improved, they remain below pre-GST levels as a percentage of GSDP, revealing room for better compliance and administration.

State expenditures, however, paint a more challenging picture. Over 55% of spending is committed to inflexible obligations like pensions, salaries, and interest payments, leaving limited funds for development projects. This rigidity hampers the ability of states to invest in long-term growth initiatives. Education and healthcare, two pillars of human capital development, often bear the brunt of such fiscal constraints.

Consider the power sector—a recurring thorn in the side of state finances. State-owned power distribution companies (discoms) are notorious for inefficiency and mounting losses. These losses, fuelled by outdated infrastructure and poor management, ripple through the economy, leading to unreliable electricity supply and higher tariffs for consumers. For a state’s residents, this can mean anything from frequent power outages to escalating bills, all linked to the deeper issue of fiscal mismanagement.

Education tells another compelling story. Despite the rhetoric of prioritizing children and their futures, states often allocate meagre budgets to this sector. Underfunded schools, outdated infrastructure, and a lack of quality teachers result in subpar educational outcomes. When states prioritize immediate populist measures—such as subsidies—over long-term investments, the ripple effects are felt across generations.

Yet, all is not bleak. The adoption of technology has ushered in a new era of efficiency and transparency. States like Gujarat and Haryana are leveraging innovations like GST Seva Kendras and QR code systems to streamline tax compliance and reduce leakages. These efforts not only bolster revenues but also set a precedent for others to follow.

The looming spectre of climate change adds another layer of complexity. States face the dual challenge of managing their finances while preparing for climate resilience. This demands investments in sustainable infrastructure and proactive climate budgeting. Unfortunately, many states lag in integrating these priorities into their financial frameworks, often side-lining long-term sustainability for short-term gains.

Transparency remains a critical gap in state financial management. Without uniform standards for financial reporting, gauging the true fiscal health of states becomes a herculean task. This lack of clarity undermines accountability, leaving citizens in the dark about how public funds are utilized. A standardized and transparent reporting mechanism is not just a bureaucratic formality—it’s a cornerstone of democratic governance.

So, what’s the way forward? The fiscal puzzle demands a multi-pronged approach. Rationalizing expenditures, especially on freebies and subsidies, is imperative. States must channel resources into areas that yield long-term benefits, like infrastructure, education, and healthcare. Strengthening tax administration, expanding the tax base, and improving compliance can unlock additional revenues.

But fiscal management is not merely a numbers game. It’s about prioritizing human welfare, enabling opportunities, and fostering growth. Citizens, too, have a role to play—demanding transparency, holding governments accountable, and engaging in informed debates about financial policies.

State finances might seem distant or irrelevant, but their influence permeates every aspect of our lives. From the water we drink to the power that lights our homes, these financial decisions ripple through society, shaping its future. The question isn’t just about how states manage their money—it’s about how they balance competing demands to ensure prosperity for all.

The next time you drive on a smooth highway, face a power outage, or struggle with access to quality education, remember: the answers lie in the fiscal puzzle. It’s not just about budgets or deficits; it’s about building a future that works for everyone. And solving this puzzle isn’t just the government’s responsibility—it’s ours too.

Visit arjasrikanth.in / @DrArjasreekanth for more insights

2 responses to “The State of State Finances: The Hidden Puzzle Shaping Our Lives”

Nice post 🌅🌅

LikeLike

Fact based, unbiased article. Simply superb ! – Sudhakar Dantiki, sdantiki@yahoo.com

LikeLike