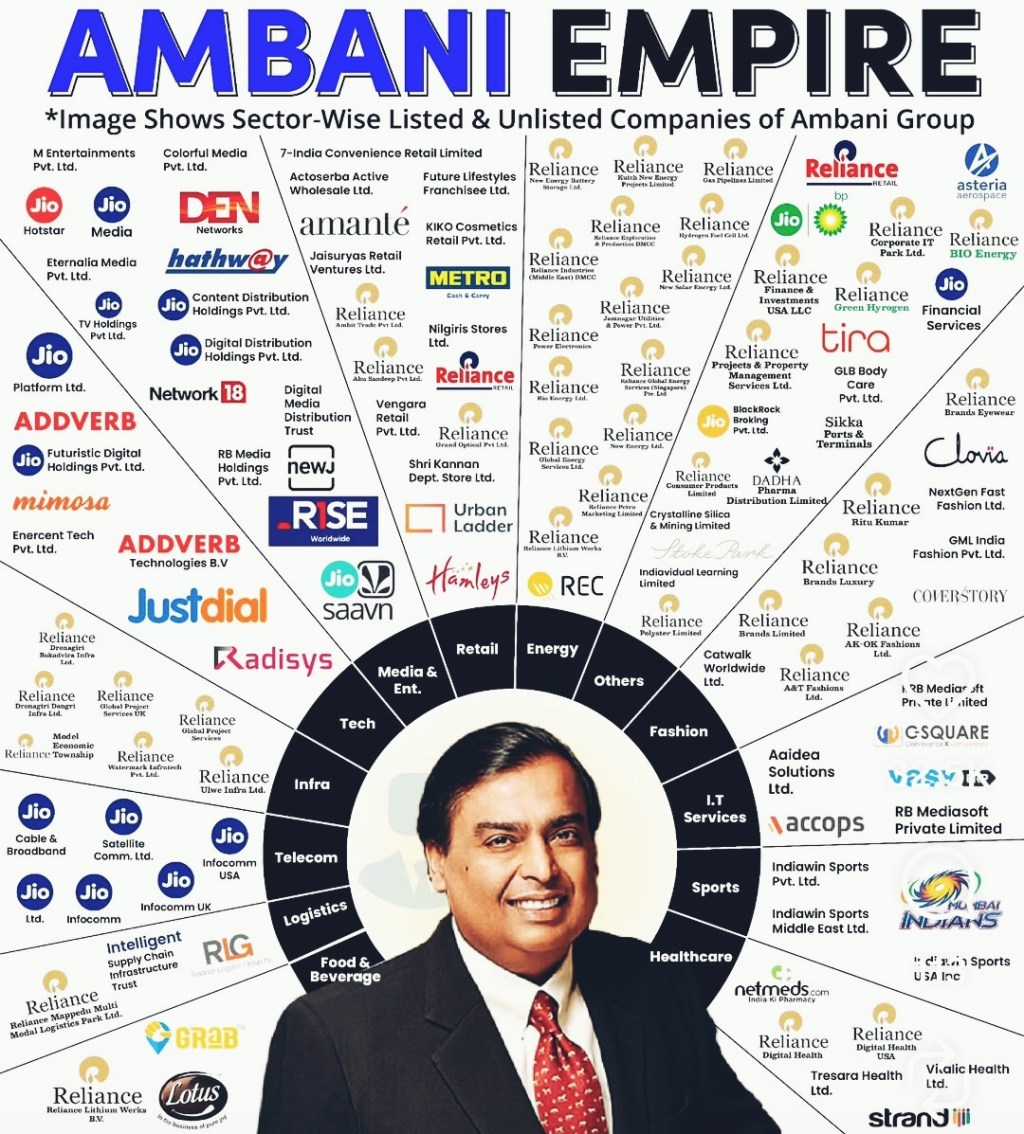

Reliance Industries now inhabits every layer of Indian life. It carries your voice, fuels your mobility, stocks your kitchen, streams your evenings—and increasingly, promises to manufacture the future itself. Few corporations anywhere command such breadth. Yet the latest results reveal an uneasy paradox: Reliance is expanding at breath-taking scale, but with diminishing clarity of purpose. Revenues look robust, profits respectable, and capital expenditure relentless. But beneath the surface lies a conglomerate running multiple races at once—some well-paced, some overstretched, and a few with no clear finish line in sight.

Jio illustrates both the strength and the ceiling of this model. Crossing 505 million subscribers after adding 9 million in a quarter sounds triumphant until one recalls that India’s mobile market is saturated. Growth now comes from consolidation, not creation. Jio has effectively captured nearly all net additions in the industry, a testament to market power rather than market expansion. ARPU (Average Revenue per User) has edged up to about ₹214 through higher data usage, 5G adoption, and fixed wireless broadband—not tariff hikes. Execution is competent, even impressive. But maturity brings limits. Enormous 5G investments still await decisive monetisation, and global ARPU benchmarks remain out of reach. Jio is extracting more value from a finite base, not unlocking a new frontier.

Reliance Retail exposes the sharper contradiction. Quarterly revenues crossed ₹97,600 crore, yet profits remained stubbornly flat at around ₹6,900 crore. Scale is rising; efficiency is not. The company is aggressively expanding stores, logistics, and quick commerce, which now processes roughly 1.6 million daily orders. While contribution margins are positive, profitability remains elusive. With fewer than 30% of fulfilment points as dark stores, the hybrid physical–digital model is capital-intensive. Retail here is being engineered for dominance, not disciplined returns—growth is purchased upfront, with payoff deferred indefinitely.

The oil-to-chemicals business, long the cash engine, delivered strong numbers—but largely thanks to global disorder rather than internal innovation. Refining margins surged amid geopolitical disruptions, supply constraints, and overseas shutdowns. Reliance benefited because of scale and efficiency, not strategic reinvention. Simultaneously, petrochemicals struggled under weak demand and Chinese oversupply. The result is a business that still throws off cash but is increasingly exposed to volatility rather than insulated by strategy.

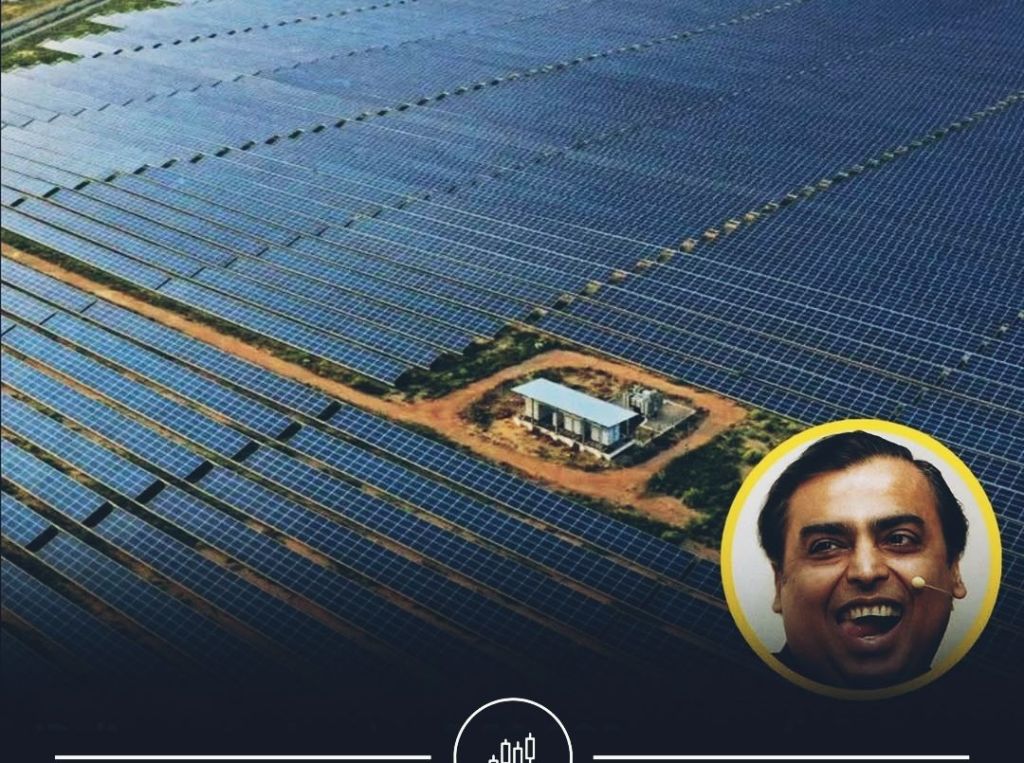

Then comes the grand wager: new energy. Nearly ₹8,000 crore per quarter is being invested to build an end-to-end solar, battery, and green hydrogen ecosystem. Strategically, it aligns with India’s energy security ambitions. Economically, it is a long, uncertain journey. Revenues are distant, profits further still, and much early output will be consumed internally. Green hydrogen remains speculative. This is vision at its boldest—but also capital at its most patient.

Taken together—soft advertising markets, a nascent consumer brands portfolio, and unrelenting capex across verticals—Reliance appears less focused than formidable. Each business makes sense in isolation; together they diffuse attention and returns. The challenge is no longer ambition but allocation. Reliance has perfected the art of becoming vast. The next test is harder: becoming precise, disciplined, and consistently profitable. In today’s markets, ubiquity is easy. Earning excellence everywhere is not.

Visit arjasrikanth.in for more insights