India’s economy is undeniably expanding. GDP curves climb confidently, global capital keeps flowing in, and the country is routinely hailed as the fastest-growing major economy on earth. But growth, it turns out, is not the same as progress. Beneath the celebratory numbers lies a far more troubling reality laid bare by the World Inequality Report 2026: India is not merely growing—it is concentrating. Wealth and income are accumulating at the very top, while insecurity hardens below. Inequality is no longer a side effect of development; it is becoming its operating system.

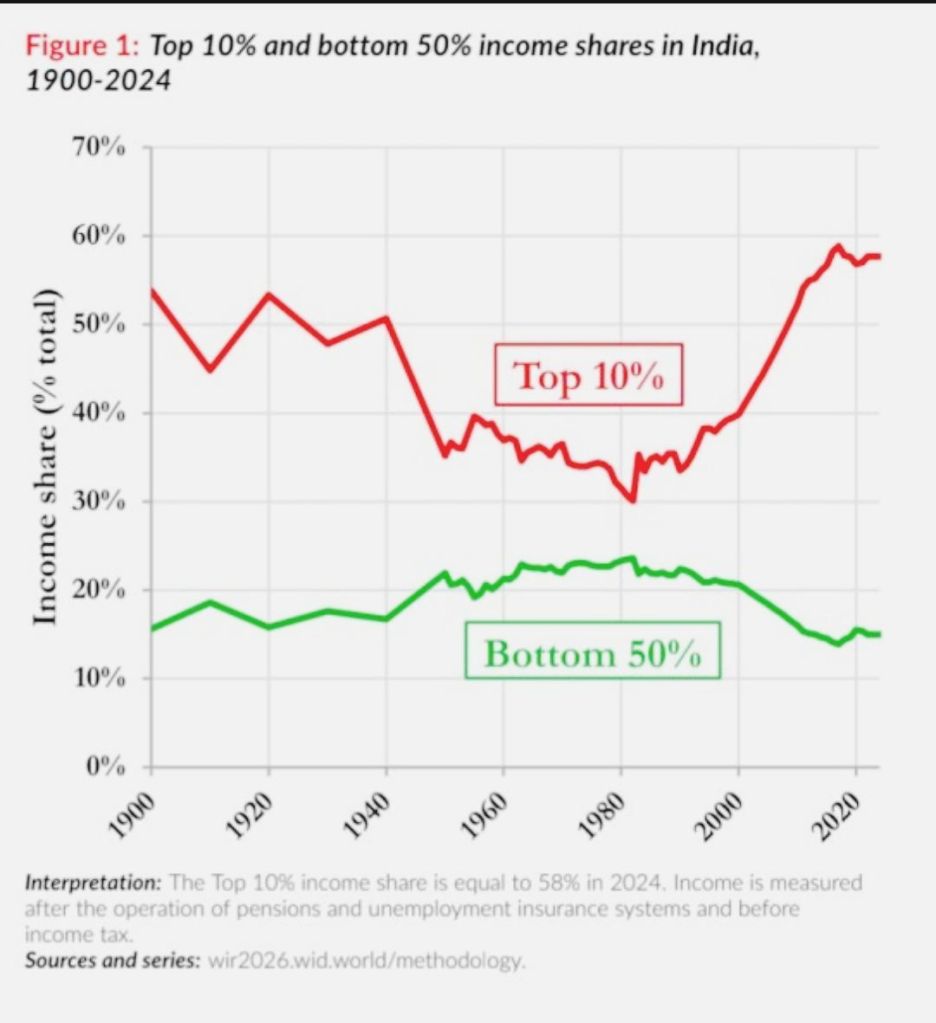

The first mistake we make is treating income and wealth as interchangeable. They are not. Income is a flow—wages, salaries, profits earned in a year. Wealth is a stock—what accumulates over time as land, housing, financial assets, and business ownership. Wealth determines power, resilience, and future opportunity. Across the world, wealth is always more unequal than income. In India, both are sharply tilted upward. The top 1% now control around 40% of national wealth. The top 10% together hold nearly 65%. On the income side, the richest 10% capture about 58% of all earnings, while the bottom half of the population survives on just 15%. These are not transitional gaps caused by rapid growth. They are structural outcomes of how India’s economy now distributes rewards.

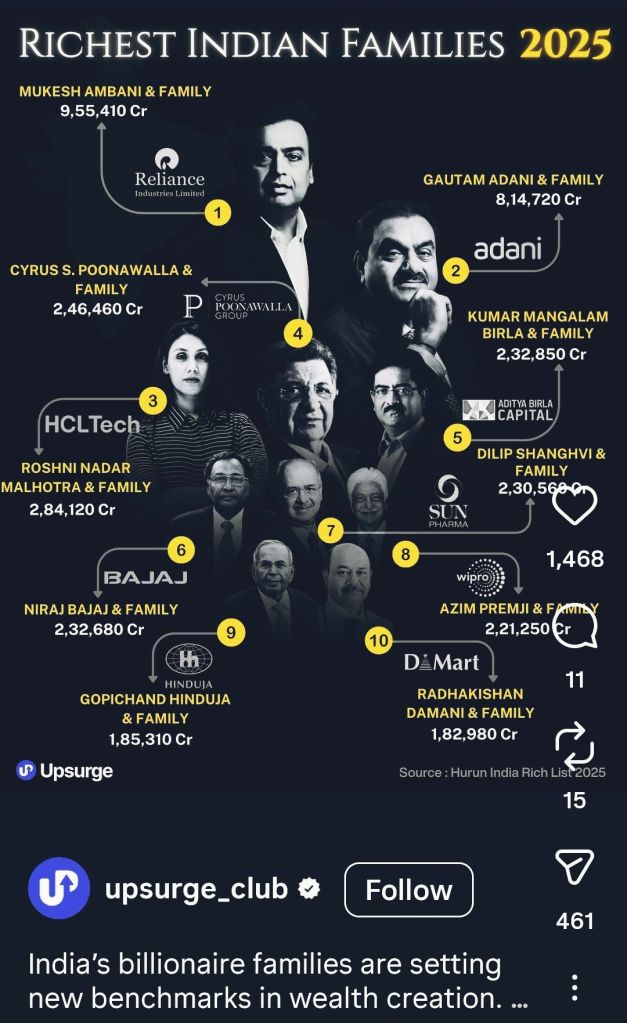

The distance becomes even more surreal when one looks at the summit. In 2025, India’s 100 richest individuals reportedly lost about $100 billion in combined wealth due to a weak rupee and softer markets. Mukesh Ambani still tops the list at roughly $105 billion, followed closely by Gautam Adani at about $92 billion, despite double-digit declines. Most billionaires “lost” money last year—and yet together they still command nearly $1 trillion in wealth. Even loss, at this level, is an abstract concept. The scale itself reveals the chasm between India’s elite and everyone else. When the richest stumble, they land on mattresses of capital; when ordinary Indians fall, they hit concrete.

Globally, inequality is severe and worsening. The richest 10% of the world receive 53% of global income and own roughly 75% of all personal wealth. The poorest half of humanity—about 2.8 billion adults—own just 2% of global wealth and earn only 8% of income. The top 1% alone controls 37% of global wealth, more than 18 times what the bottom half owns combined. This is the grim global baseline. Yet India still manages to stand out. India’s richest 10% now hold an estimated 77% of national wealth—placing the country among the most unequal societies on the planet, despite its democratic framework and development ambitions.

The reasons are familiar but intensifying. A massive informal workforce suppresses wages and job security. Unequal access to quality education locks millions out of high-paying sectors. Weak social protection systems mean that a single illness or accident can erase years of savings. In fact, an estimated 63 million Indians are pushed into poverty every year due to healthcare costs alone. But these long-standing fault lines are now being widened by a powerful new force: India’s shift toward capital-intensive growth.

Indian companies are adopting automation, artificial intelligence, and advanced digital systems at remarkable speed. According to global employment studies, Indian firms are among the fastest adopters of these technologies. Productivity and profits are rising—but jobs are not. Capital increasingly rewards capital. High-skilled workers and asset owners benefit disproportionately, while millions compete for fewer, lower-quality jobs. Labour-intensive sectors such as manufacturing, construction, and low-end services have not grown fast enough to absorb the workforce entering the economy each year. The result is a widening paradox: strong macroeconomic growth alongside fragile household realities.

This dynamic explains why wealth inequality is accelerating even faster than income inequality. Those who already own assets—land, shares, businesses—see their wealth compound through markets and technology. Those dependent on wages struggle to save, let alone invest. Over time, inequality becomes self-reinforcing. Advantage multiplies quietly; disadvantage hardens into permanence. Geography deepens the divide. States like Gujarat, Karnataka, and Tamil Nadu surge ahead, powered by investment and skilled labour, while Bihar, Jharkhand, and Uttar Pradesh lag far behind. Bihar’s per capita income has fallen to just 29.6% of the national average. Growth, even within India, is profoundly uneven.

What makes this moment especially dangerous is that inequality is no longer an accidental outcome—it is becoming a policy choice. India could prioritize growth models that generate mass employment, broaden asset ownership, and invest heavily in healthcare, education, and social protection. It could strengthen progressive taxation and curb excessive concentration of economic power. Or it can continue celebrating headline growth while quietly accepting that its benefits will narrow.

This is not merely an economic concern; it is a social and political one. Extreme inequality erodes trust, weakens social cohesion, and amplifies polarization. When large sections of society feel excluded from progress, consumption weakens, resentment grows, and institutions lose legitimacy. Ironically, excessive concentration of wealth can destabilize the very system that enables wealth creation in the first place.

The pattern is already repeating in new sectors. As traditional industries consolidate, digital markets—from platforms to OTT services—are showing early signs of monopoly and dominance by a few deep-pocketed players. Growth followed by concentration has become the default script.

India is producing more than ever before. The unanswered question is who gets to own this production, who benefits from it, and who is left reading inequality reports while prosperity passes overhead. Inequality is not destiny. But ignoring it is a decision—and one that will shape India’s future far more profoundly than any GDP milestone ever could.

Visit arjasrikanth.in for more insights

One response to “THE GDP IS SHINING, THE PEOPLE ARE NOT: India’s Growth Story Written in Gold at the Top and Pencil at the Bottom”

Sir, Very interesting, many thanks for sharing this information

LikeLike