THE GREAT RUPEE ILLUSION: OUR CURRENCY FALLS, POLITICS RAGES, AND ECONOMICS JUST SHRUGS

The value of a nation’s currency is often mistaken for its economic strength, but in reality, it is a mirror reflecting a far more complex interplay of global tides, domestic fundamentals, and political narratives. In India, the rupee’s every movement becomes a political battleground, a subject of angry television debates and triumphant social media proclamations. Yet currencies do not bow to ideology. They follow arithmetic, not emotion; structure, not sentiment. Countries like China have long understood this, deliberately keeping the yuan weak to push exports because their economy produces more than it consumes. India, conversely, has inherited a peculiar tradition of currency nationalism—the belief that a rising rupee is a rising nation. This is a comforting myth, but a myth nonetheless. The rupee’s multi-decade slide—from ₹42 per dollar in 1999 to breaching ₹90 today—is not a story of political failure but of predictable economic logic driven by inflation differentials, trade imbalances, and global shocks that do not pause for elections.

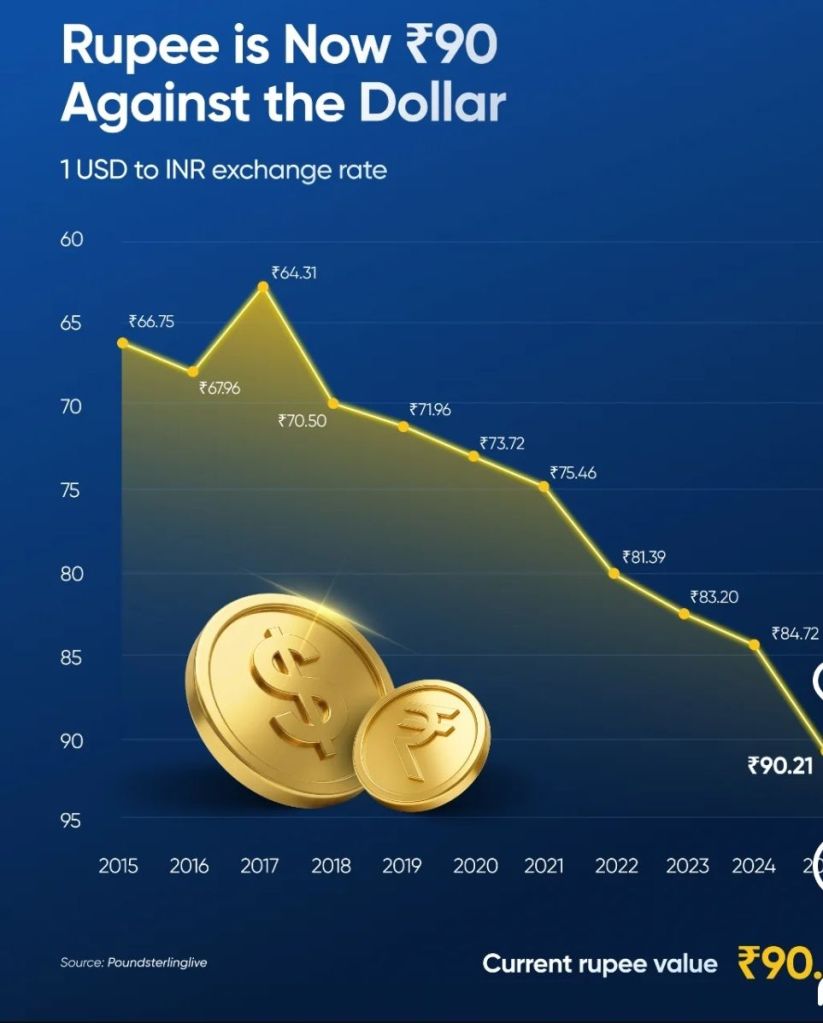

A closer look at history shows a pattern more consistent than political rhetoric acknowledges. The journey from ₹40 to ₹50 took 11 long years, from ₹50 to ₹60 a shorter 4 years and 7 months, and from ₹60 to ₹70 a little over 5 years. The decline from ₹80 to ₹90—just over three years—was the fastest, even though the percentage change was smaller due to the higher base. This downward drift aligns with the experience of many emerging-market currencies, but India’s case appears more dramatic because of its dependency on imports, particularly oil. Every $10 rise in crude prices widens the current account deficit by billions. As RBI Governor has consistently reiterated, currencies ultimately follow economic laws. A developing country with higher inflation than its trading partners will see its currency depreciate—an outcome neither sudden nor catastrophic. What rattles the political imagination is not the depreciation itself but the pace of it—and the uncomfortable comparison with other currencies that have strengthened even as the rupee has weakened.

Yet the rupee does not move in an Indian vacuum. It moves in a world still dominated by the gravitational pull of the US dollar. The dollar’s recent surge is driven by higher American interest rates, combined with Donald Trump’s renewed assault on the Federal Reserve and his ideological fixation— that a strong dollar harms American industry. These pressures have stirred volatility, encouraging global investors to rush toward the dollar as a safe haven. While several global currencies have gained ground, India and Indonesia have bucked the trend, weakening instead. For India, the strain is compounded by trade tensions with the US, rising merchandise deficits, and stalled expectations of an early India–US trade pact. The absence of such an agreement has dented investor confidence, and in global markets, perception often becomes reality faster than policy.

Capital flows further complicate the picture. Foreign portfolio investors have already pulled out nearly $17 billion this year—a massive outflow—while net FDI has turned negative despite gross inflows of $6.6 billion. Investors, shaken by global uncertainty, have booked profits in Indian markets or sought safer grounds. Instead of the anticipated “China-plus-one” wave, capital has begun flowing back into China, surprising policymakers. Meanwhile, Indian households, sensing inflationary pressures, have increased their gold and silver purchases, exacerbating imports and widening the trade deficit. Such dynamics create a feedback loop: exporters delay invoicing, anticipating a better dollar rate, while importers rush forward, fearful of further depreciation. The rupee, caught in this tug-of-war, naturally drifts downward.

Through all of this, the Reserve Bank of India has played a stabilizing but intentionally restrained role. With nearly $600 billion in reserves, the RBI has the firepower to intervene aggressively—but it chooses not to. Heavy-handed intervention risks inviting speculative attacks, the kind famously led by George Soros against countries defending unrealistic currency levels. Instead, the RBI uses a measured “crawling arrangement”—allowing the rupee to adjust gradually while stepping in only to curb sharp volatility. Earlier this year, it quietly sold $33 billion to smooth the descent, and later switched strategy to accumulate $60 billion in forward positions. This dual approach acts as both a shield and a future buffer, ensuring India neither defends an overvalued currency nor becomes vulnerable to sudden shocks. The message is clear: stabilizing the rupee is prudent; artificially strengthening it is dangerous.

The consequences of a declining rupee are mixed, not uniformly grim. Remittances—India’s powerful financial engine—receive a boost, giving families back home more value in rupees.

Exporters gain competitiveness. On the other hand, imports become costlier, external debt obligations rise, and inflationary pressures creep in through higher fuel and electronics prices. Fortunately, India’s inflation remains under control, shielding the economy from immediate turmoil. The essential insight is straightforward: exchange rates reflect long-term fundamentals, not short-term pride. The rupee is not in crisis—it is in transition, adjusting to India’s evolving economic structure and global position.

The broader truth is simple yet often misunderstood: a weaker rupee does not mean a weaker India. Much like a stronger rupee does not automatically signify national greatness. The real challenge lies in fixing fundamentals—expanding exports, diversifying supply chains, reducing dependence on imported energy and electronics, and attracting long-term, stable investment. Above all, India must discard currency nationalism and embrace currency realism. Those who promised ₹1 = $1 were never selling economics—they were selling fantasy.

The rupee’s journey is neither a tragedy nor a triumph. It is a trajectory—a long-term glide shaped by forces larger than partisan politics. And as India evolves, its currency will continue to adjust. The task is not to stop the depreciation but to ensure the nation becomes stronger even as the rupee becomes weaker. The Great Rupee Illusion will persist, but with sound policies, India can navigate the turbulence with confidence, clarity, and maturity—proving that strength lies not in the currency’s value, but in the economy that stands behind it.

Visit arjasrikanth.in for more insights