From street-side chai to crore-dollar deals, three little letters—UPI—are rewriting how India spends, saves, and thinks about money. Cash may survive, but it’s officially on probation.

In 2016, the Unified Payments Interface—better known as UPI—arrived quietly, almost like a side experiment in India’s long journey toward financial digitization. Fast forward to 2024–25, and that experiment has exploded into a revolution that touches every corner of the economy. Today, UPI powers over 17 billion transactions every month, commanding nearly 84% of India’s digital payments. But amid this whirlwind, a pressing question emerges: has UPI truly loosened India’s decades-long love affair with cash?

The answer, revealed in the Reserve Bank of India’s September 2025 bulletin, is both fascinating and transformative. The study, titled “Impact of UPI on Cash Demand: Evidence from National Levels,” explores not just payment patterns but the very heartbeat of India’s financial system. Cash isn’t just currency—it’s a logistical beast. Printing, transporting, and replenishing it across thousands of ATMs drains both resources and liquidity. Digital payments, on the other hand, keep money circulating within banks, enabling faster policy transmission and making the economy more efficient. The question of whether UPI reduces cash use isn’t theoretical—it’s foundational.

The RBI study examined four questions: does UPI adoption reduce cash demand nationally? How do states differ in reliance on cash? Does income level matter? And is UPI a substitute or complement for cash? The answers reveal a nation in transition.

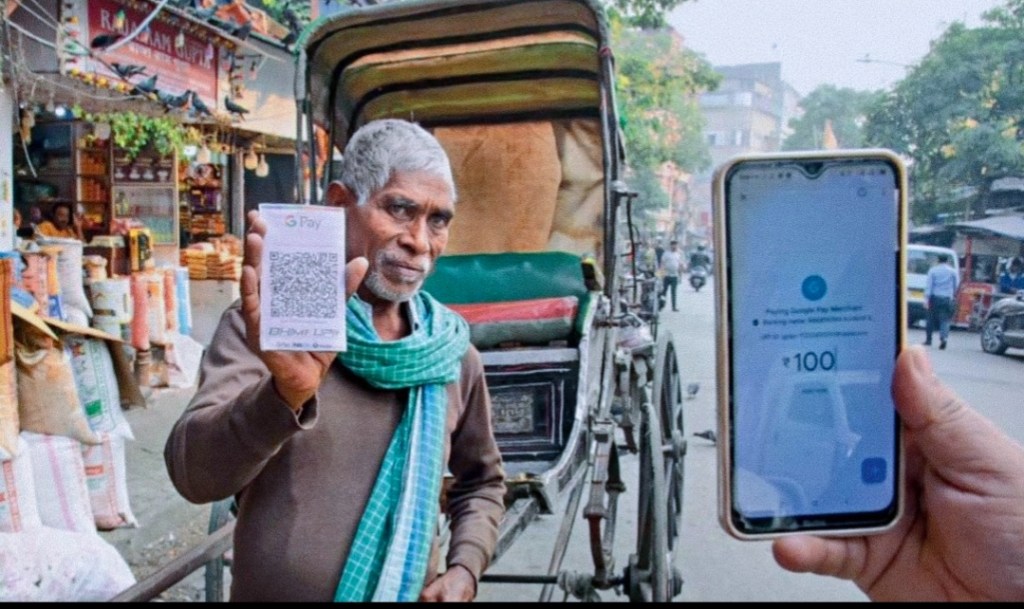

Nationally, the picture is clear: UPI is nibbling away at cash. Currency in circulation still grows, but the pace has slowed sharply. Annual cash growth now hovers between 4–6%, and real cash demand actually declined in 2023–24. Transaction sizes tell an even more compelling story: the average UPI transaction shrank from ₹3,867 in 2016–17 to ₹1,404 in 2024–25, proving Indians trust UPI for everything—from street-side chai to bus fares.

The “currency-to-deposit ratio,” a key indicator of how much cash people hoard relative to bank deposits, has dropped from 1.68 in 2015–16 to 1.31 in 2024–25. ATM withdrawals as a share of GDP have been steadily declining since 2018–19. India isn’t cash-free, but it is undeniably “cash-lite.”

Yet the UPI wave hasn’t hit uniformly. Ten states account for nearly 80% of UPI volumes—led by Telangana, Andhra Pradesh, Delhi, and Maharashtra—benefiting from strong digital infrastructure, urbanization, and proactive policies. Meanwhile, North Eastern states cling to cash, hampered by patchy connectivity, limited banking, and cultural habit.

The pandemic accelerated digital adoption, pushing millions to go cashless for safety reasons. Even laggard states saw a surge in UPI use, narrowing regional gaps. Interestingly, it isn’t the richest states driving this change but middle-income ones, where digital infrastructure, smartphone penetration, and literacy have created a perfect storm for adoption.

Education and formal employment emerge as powerful enablers. Salaried citizens, tech-savvy workers, and literate populations are natural adopters, while informal labor and older generations cling to cash. UPI’s rise, then, is a reflection not just of technology but of India’s socio-economic landscape.

However, even UPI has limits. Early adoption sharply reduces cash use, but over time, the effect plateaus. Behavioral inertia—habit, trust, and tradition—ensures that cash remains for small vendors, informal loans, wedding gifts, and temple offerings. India is thus moving toward a “cash-lite” future, not a cashless one.

The victory isn’t in obliterating cash but in giving people the freedom to transact digitally safely and seamlessly. UPI has democratized finance, empowered millions, and proven that public digital infrastructure can drive private innovation. It has transformed India into the planet’s most vibrant real-time payment laboratory, where a ₹10 chai and a ₹10 lakh transaction share the same technological DNA.

In 2025, cash isn’t dead—it’s learning to coexist with a formidable rival that fits in your pocket. And that rival, with just three letters, has changed everything: UPI.

Visit arjasrikanth.in for more insights