A crop once mocked as surplus has turned into a ₹1,800-crore export empire, proving that revolutions can be salty, crunchy, and golden.

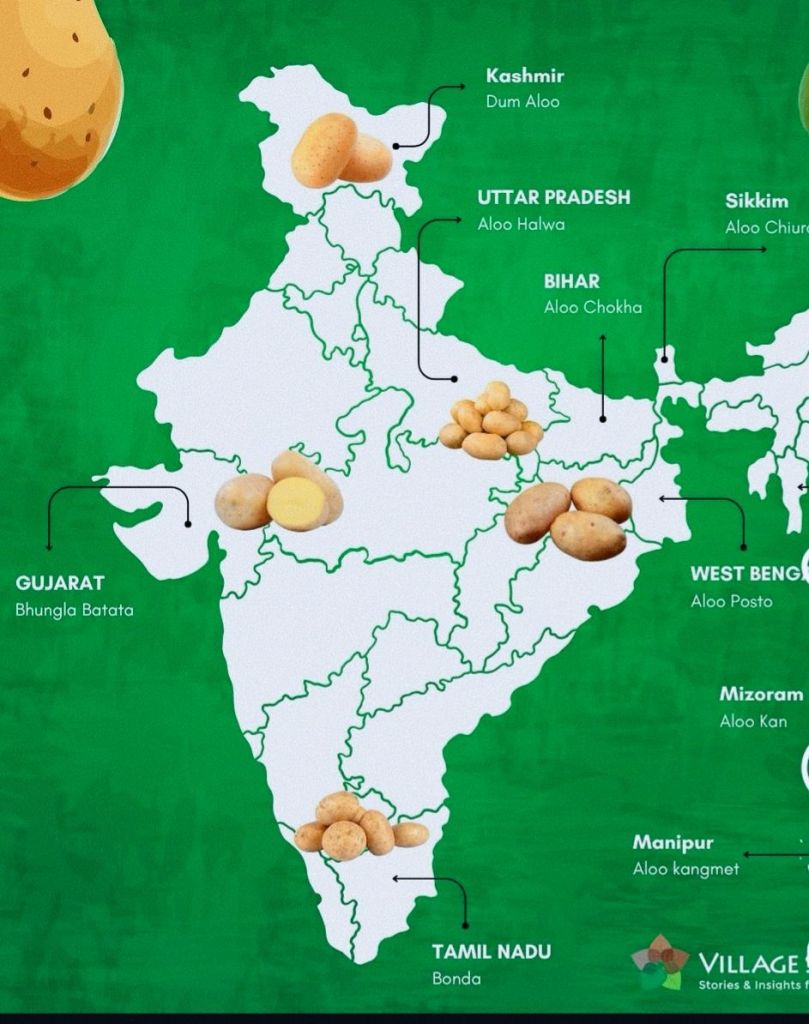

Not so long ago, the idea of India competing with Europe or the United States in the French fry business would have seemed laughable. Potatoes were not even native to India—they hailed from South America and arrived here only in the late 16th or early 17th century with Portuguese traders, before the British spread them widely across Bengal and beyond. For centuries, the humble aloo was a simple relief crop for households and never a money-spinner. In fact, as recently as the mid-2000s, India was a net importer, bringing in 5,000 to 7,000 tonnes of potatoes a year. Farmers in Bihar, Uttar Pradesh, and West Bengal often dumped excess harvests back into the soil because selling them wouldn’t even cover transport costs. Yet today, the story is startlingly different. India produces nearly 60 million tonnes of potatoes annually, second only to China, and has emerged as a frozen fry powerhouse with exports soaring to nearly ₹1,817 crores ($217 million) in FY25—nine times the figure from just five years ago.

This meteoric rise was neither accidental nor overnight. It began in the late 1990s when McCain Foods, the world’s largest producer of frozen potato products, set up shop in India. But the real spark came in 2017 when Lamb Weston, another American giant, opened a processing plant in Gujarat and struck gold by becoming the exclusive supplier for McDonald’s outlets across India. Once big restaurants realized the demand for fries was exploding, Indian processors like HyFun Foods, Iscon Balaji, Farmway, and Chill Foods piled in, determined not to leave the golden opportunity to multinationals alone. Together with global heavyweights such as Cavendish and Lamb Weston, they built empires out of fries, and Gujarat quickly emerged as the epicenter of India’s potato revolution.

The strategy was simple yet transformative: contract farming. Instead of relying on ordinary Indian table potatoes, which carried too much sugar and water to fry evenly, companies introduced European processing varieties like Santana and Innovator. These yellow-fleshed tubers produced fries that were crisp, golden, and uniform—the kind global buyers demanded. Farmers received certified seeds, modern irrigation techniques, and guaranteed prices of ₹25–30 per kilogram, often with access to credit and agronomic guidance. In return, processors got a steady supply of high-quality potatoes. For farmers, the change was life-altering; average incomes jumped 75% since 2017, and instead of despairing over crop gluts, they now enjoyed assured demand and stable returns.

At the same time, scientists at ICAR and the Central Potato Research Institute developed indigenous varieties like Kufri Frysona with low sugar and high dry matter to complement imported strains. Coupled with investments in cold storage and refrigerated logistics, India suddenly had the ecosystem to compete globally. Gujarat’s mild winters and long days turned out to be perfect for processing potatoes, and today the state accounts for 80% of the country’s output. Madhya Pradesh and Punjab are catching up fast, adding scale to what has become a quiet agri-industrial revolution.

The results speak volumes. India’s frozen fry exports crossed the 20,000-tonne mark for the first time in February 2025, with annual shipments touching 181,773 tonnes—a 45% year-on-year increase. Markets once dominated by Belgium, the Netherlands, and the U.S. now look to India as a reliable alternative. From the Philippines, Thailand, and Indonesia in Southeast Asia to Saudi Arabia and the UAE in the Middle East, Indian fries are replacing imports that used to travel from Europe’s faraway ports. The domestic quick-service restaurant market—from McDonald’s to Burger King to countless homegrown brands—has also provided steady demand, making India one of the fastest-growing fry markets globally.

Yet, the road ahead is not entirely smooth. Infrastructure remains a pressing constraint. Only about 10–15% of India’s cold storage capacity is suitable for frozen foods, and the shortage of refrigerated trucks poses spoilage risks. Frequent power outages add another layer of uncertainty to a supply chain that thrives on temperature precision. There are also deeper ecological concerns: potato farming demands 500–700 millimetres of water per cycle, and erratic monsoons combined with groundwater depletion threaten long-term sustainability. Companies are therefore investing in climate-resilient seed varieties, drip irrigation, and renewable-powered cold chains to mitigate risks.

Still, the optimism is palpable. With major investments lined up from McCain, HyFun, and others, India is aiming to become Asia’s second-largest frozen fry exporter after China by 2027. The global French fry market, worth around $24 billion, is hungry for reliable suppliers, and India has proven it can deliver quality at competitive prices—sometimes even undercutting China. Farmers have moved from despair to confidence, processors from trial-and-error to global scale, and policymakers from worrying about imports to celebrating exports.

It’s an unlikely love story, this Indian affair with the French fry. From arriving on the Malabar Coast centuries ago as a foreign curiosity to being reimagined in modern Gujarat as a global commodity, the potato has carved out a new destiny here. India once buried unsold crops back into the earth; now it ships golden fries to half the world. And as the industry scales new heights, one can’t help but wonder if the day is not far when India will proudly stand shoulder to shoulder with Belgium and the Netherlands as one of the planet’s largest fry exporters—proof that sometimes the crispiest revolutions are also the most delicious.

Visit arjasrikanth.in for more insights