When the GST Council swaps rockets for revenue math, the real fireworks aren’t in the sky but in India’s balance sheets—can lighter tax rates still keep the lamp of revenues glowing bright?

As India readies itself for the festive season, the familiar sparkle of diyas and the aroma of sweets mingle with a different kind of anticipation—the crackle of debate inside the GST Council. This year’s fireworks are not limited to the skies but are unfolding in fiscal policy, where the government is weighing a bold restructuring of the tax slab system. If Diwali has long been a festival of prosperity, this “Fiscal Diwali” is about arithmetic: can India simplify and lower GST rates while still keeping the lamps of revenue glowing bright for both Centre and states?

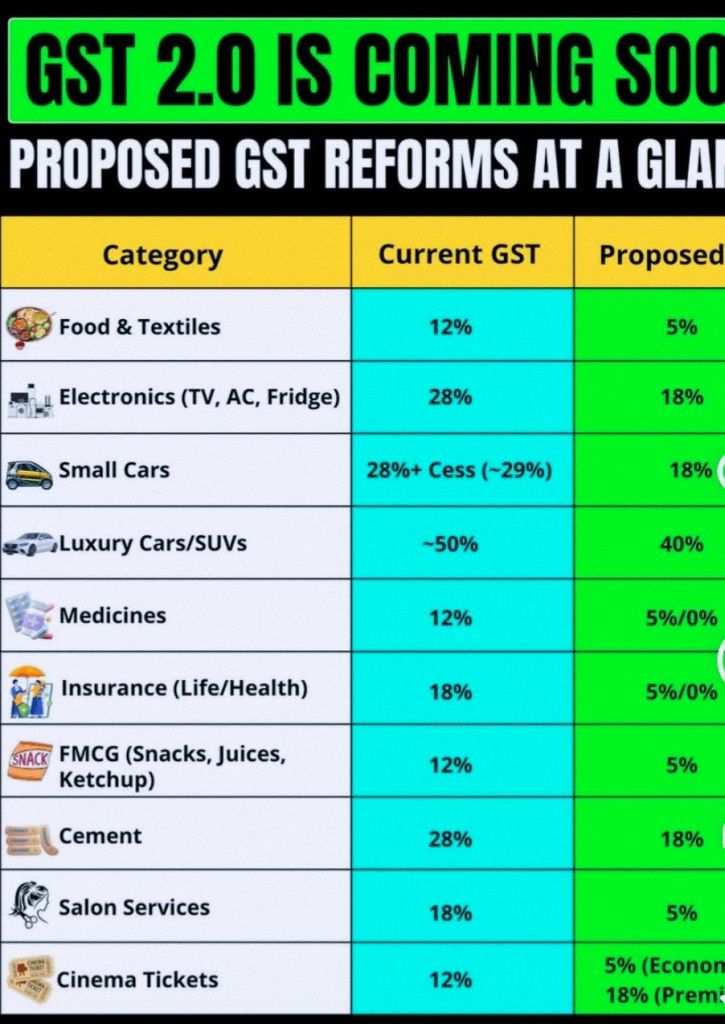

At the center of discussion lies the dramatic proposal to merge the existing 28% and 12% tax brackets into a streamlined 18% slab. On paper, this seems rational, offering simplicity for businesses and relief for consumers. Yet beneath the festive packaging lies a complex game of fiscal trade-offs, federal bargaining, and economic psychology. The immediate risk is clear: potential revenue leakage estimated between ₹60,000 crore and ₹1 lakh crore annually—nearly 0.23% of GDP. Even a cautious rollout could leave the first year dented by ₹45,000 crore. For policymakers, it is the classic Diwali gamble: light a sparkler of reform and hope it dazzles, or risk being left with only smoke.

History, however, offers comfort. Tax reforms tend to stumble initially before steadying. When GST rates were slashed on more than 2,200 items in 2017, fears of a fiscal nosedive spread like wildfire. Collections did indeed dip, but as e-invoicing, online return filing, and data analytics tightened compliance, revenues rebounded. Today, GST collections are robust, crossing ₹22 lakh crore annually, with monthly inflows hovering around ₹2 lakh crore. This suggests rationalization may actually widen the base: lower rates can boost consumption, reduce evasion, and bring more players from the shadow economy into the formal system. Meanwhile, higher taxes on sin goods—pushed up to 40% for items like tobacco—are designed to offset revenue loss, keeping harmful consumption costly while adding ballast to the exchequer.

But arithmetic alone does not decide India’s fiscal fireworks. Politics, especially federal politics, adds its own colour. GST revenues are split equally between the Centre and states, yet the pain of cuts is unevenly distributed. Industrial states such as Maharashtra, Gujarat, Tamil Nadu, and Karnataka lean heavily on urban consumption of high-value goods like automobiles, appliances, and electronics. These are precisely the sectors where rate cuts sting the most. Agrarian states, by contrast, feel little burn since essentials dominate their consumption basket and remain largely exempt or minimally taxed. When slabs were slashed in 2018, some industrial states reported revenue losses of nearly 24%, while smaller states hardly noticed.

This asymmetry explains why compensation remains a political flashpoint. States had enjoyed a five-year safety net, extended further during the pandemic, but that cushion has now vanished. They argue that sweeping reforms of this scale deserve renewed protection. The Centre retorts that perpetual compensation breeds fiscal dependency and blunts local reform incentives. Somewhere in the middle lies a compromise: special funds from cess collections, or targeted transfers to particularly vulnerable states, balancing fairness with reform momentum.

Meanwhile, the choreography of reform is being carefully staged. Hiking rates on luxury and sin goods is not only a fiscal counterweight but also a moral and policy signal. For India, the larger trajectory is unmistakable: nudging the overall average GST rate closer to 10%, compared to the pre-GST effective average of 15%. Yet as with any grand production, disputes over category shifts, transitional losses, and implementation speed are bound to spark. The GST Council, traditionally a forum for cooperative federalism, now faces the task of managing both trust and tensions as fiscal fireworks light up the horizon.

For states, the real challenge lies not in wrangling for perpetual bailouts but in adapting to a new fiscal reality. Reliance on compensation dilutes reform spirit. Expanding their own tax base, plugging leakages, leveraging industrial and infrastructure policy, and embracing compliance technologies will ultimately ensure resilience. A stable and buoyant GST ecosystem could turn India into a competitive consumption-driven manufacturing hub, allowing states to reap long-term dividends.

At its core, GST restructuring is less about today’s losses and more about tomorrow’s opportunities. A simpler, rationalized tax structure has the power to stimulate demand, build compliance, and align India’s fiscal architecture with global norms. But the gamble rests in execution. Handled with transparency and consensus, it could ignite a brighter era of growth, competitiveness, and cooperative federalism. Mishandled, it risks scorching fiscal balances and deepening mistrust between the Centre and states.

Like a Diwali sparkler, the GST gambit is thrilling but unpredictable. Light it carefully, and it could illuminate India’s economic future in dazzling arcs of prosperity. Mismanage it, and the smoke may linger long after the glow fades. The coming months will reveal whether these fireworks in taxation signal the dawn of a brighter fiscal festival—or the beginning of a costly misstep.

Visit arjasrikanth.in for more insights