India’s lenders aren’t crashing—but with slowing credit, margin squeezes, and a sugar rush from treasury gains, the sector must rebuild the engine while still speeding down a melting highway.

The first Indian banks are not collapsing, but they’re not winning either, and if you zoom out from the polite quarterly reports, you’ll see a sector balancing on thin ice while juggling umbrellas. Q1 FY26 brought no shocks, no meltdowns—yet the undercurrents are anything but calm. Credit growth across the system slowed to 8.9%, with private banks tiptoeing at 8.1% and public sector banks surprisingly brisk at 11% thanks to a government nudge toward priority lending in MSMEs, agriculture, and rural sectors. That gave PSBs a growth story, but at the expense of profitability. Private banks, meanwhile, stayed cautious, protecting margins and avoiding the high-volume, low-yield game. The real drag is the reluctance of large industries to borrow—corporate capex pipelines are dry, big infrastructure lending is cooling, and many companies either have cash reserves or tap markets directly. MSMEs have stepped up, but in a peculiar twist: bigger MSMEs get bigger loans, while the smallest players remain starved of credit. Even unsecured personal loans, credit cards, and vehicle loans are cooling, partly because banks are pulling back after defaults ticked higher.

The big names tell their own stories. HDFC Bank saw flat corporate lending and only 8% growth in retail loans, with SMEs as the lone bright spot. ICICI Bank’s retail lending slowed, but its SME-focused business banking surged 30%. Kotak Mahindra Bank defied the trend, growing consumer lending by 16% and total advances by 14%, hinting at market-share gains while others hesitated. Yet margins are a headache across the board. The system’s Net Interest Margin fell to 3.24%, its lowest in three years. With most loans now linked to external benchmarks like the repo rate, lending rates drop instantly when the RBI cuts, but deposit rates remain sticky. Banks earn less while still paying nearly the same to attract deposits. Add the erosion of CASA ratios—cheap savings deposits flowing into term deposits and mutual funds—and the cost of funds creeps higher. The squeeze is real: slower growth, thinner spreads, and costlier money.

Ironically, profits looked fine this quarter not because core banking shone, but because treasury desks struck gold. Falling interest rates boosted government bond prices, allowing banks to book hefty gains. Public sector banks saw treasury income more than double; private banks nearly tripled it. But this is a sugar rush, not a balanced diet. With the RBI now mopping up liquidity and bond yields likely to rise, the windfall could vanish as quickly as it came. Strip away the treasury magic, and the earnings picture looks worryingly pale.

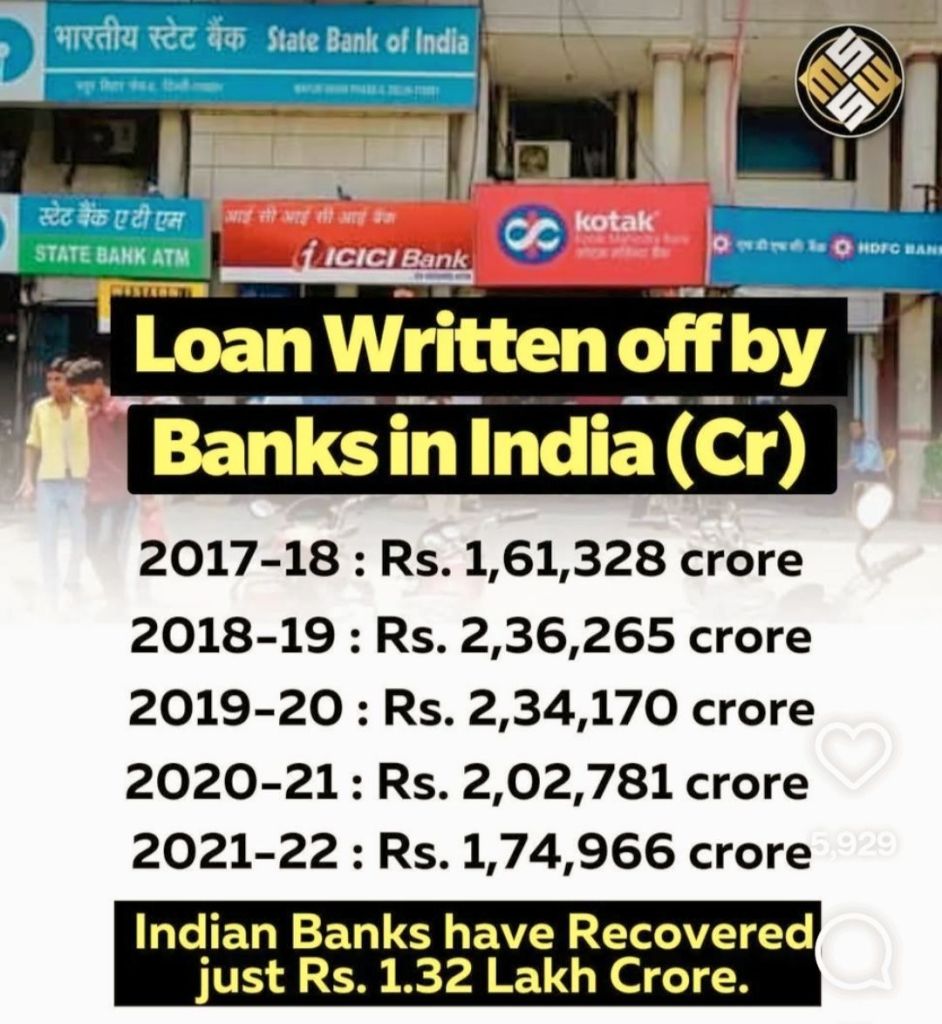

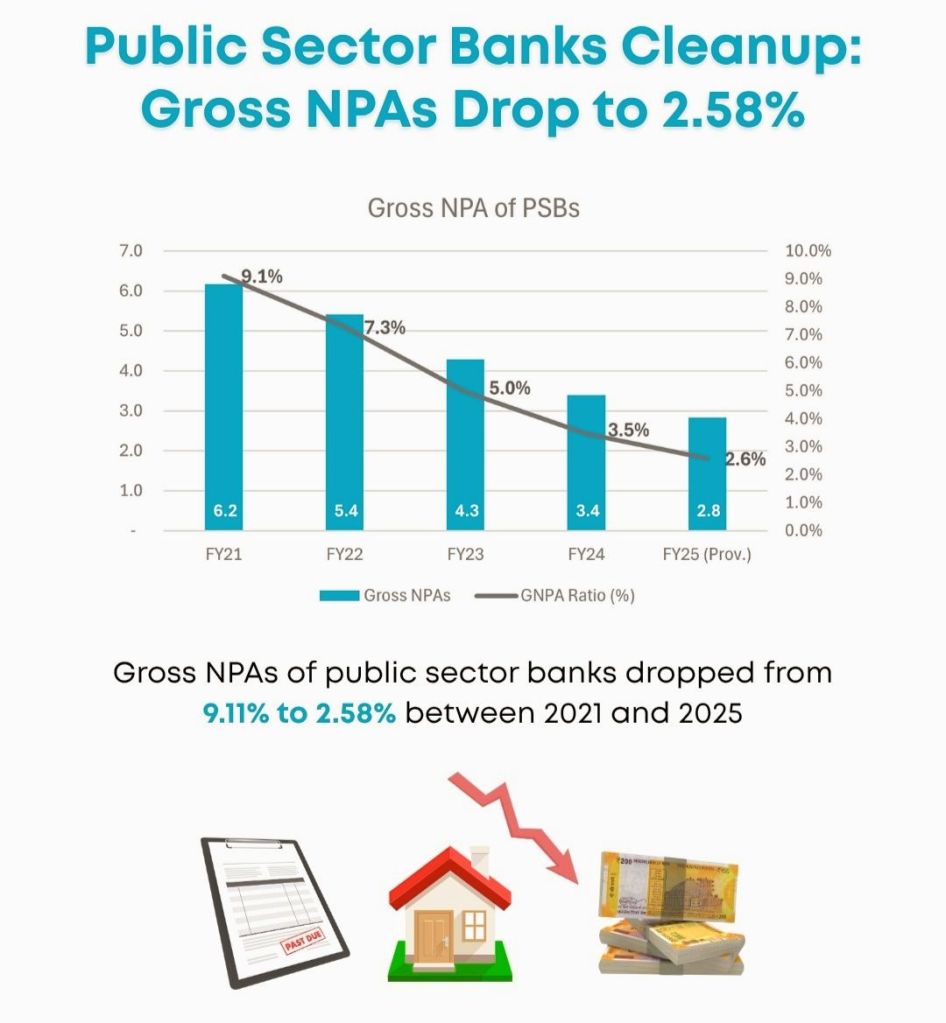

Structural challenges run deep. High NPAs, particularly in PSBs, still gnaw at balance sheets. Capital adequacy remains a hurdle for some, governance bottlenecks slow decision-making, and cyber-security threats rise with every new digital service. Fintech competitors snap up profitable niches, and financial inclusion is still uneven. Banks juggle heavy compliance costs, margin pressure, and a war for digital talent. The irony is that Indian banking is a world leader in digital payments—UPI is a global case study—yet many still run on creaky legacy systems.

Survival, however, has a blueprint. The sharper players are embracing AI-driven credit scoring, cloud adoption, and open APIs. They are building early-warning systems to detect stress before it explodes, personalizing offers with data analytics, and embedding themselves into e-commerce and supply chain ecosystems. PSBs can be insulated from bureaucratic drift with stronger governance—professional boards, robust risk frameworks—and strategic partnerships with fintechs can turn disruptors into allies. Financial inclusion also needs reinvention: data-driven micro-lending for MSMEs, products tailored for women and underserved regions, and integrating financial literacy into service delivery.

But the way forward demands more than tinkering. PSBs need real operational autonomy and, where feasible, privatization to unlock efficiency. Digital transformation must run deep—modernize core banking, embed cyber-security at every layer, and deploy AI for growth and defence. Risk management should shift from reactive to predictive, with faster NPA resolution through the Insolvency and Bankruptcy Code and deeper secondary markets for stressed assets. Banks must invest in future-ready talent—data scientists, cyber-security specialists, and agile product teams—while flattening hierarchies to speed decisions. Collaboration, not isolated competition, will define winners: shared API ecosystems, co-lending models, and joint innovation labs. And all this must align with ESG goals, financing India’s green transition through sustainable lending and climate-friendly investments.

The sector’s test isn’t whether it can survive this quarter—it can. The real question is whether it can rebuild the engine while still driving at highway speed. If it clings to treasury windfalls, slow loan growth, and a shrinking deposit base, the ice will crack beneath it. But if it leans hard into technology, governance reform, risk discipline, and inclusive growth, it could turn today’s drizzle into tomorrow’s monsoon harvest. That shift requires courage—banks must shed the comfort of chasing easy gains, regulators must enable calculated risk-taking, and policymakers must protect stability without strangling innovation.

For now, we watch banks in steel boots shuffle across the frozen surface, testing each step, hoping the water below stays solid a little longer. The juggling act continues—umbrellas spinning in the wind, eyes on the horizon, listening for the ominous crack that will demand either a leap forward or a plunge into the cold. The choice is theirs, and the season for hesitation is short. In banking, as in life on thin ice, those who move decisively are the ones still standing when the thaw comes.

Visit arjasrikanth.in for more insights