Discounted Russian Barrels Fuelled an Economic Surge, Triggered American Heartburn, and Put India in the Driver’s Seat of 21st-Century Geopolitics

When oil becomes cheaper than bottled water, disruption is inevitable—and in India’s case, the tremors are being felt across continents. Ever since India began sourcing discounted Russian crude oil in large volumes, it has not only reaped substantial economic gains but also drawn unease, if not ire, from its long-standing strategic partner, the United States. The fundamentals are clear: deeply discounted oil translates into savings worth billions, supports robust economic growth, and keeps inflation within manageable limits. Yet, in the world of global diplomacy, where energy flows are as political as they are commercial, such pragmatism rarely comes without consequences. Today, India finds itself navigating a high-stakes diplomatic balancing act—reaping energy dividends at home while managing friction abroad.

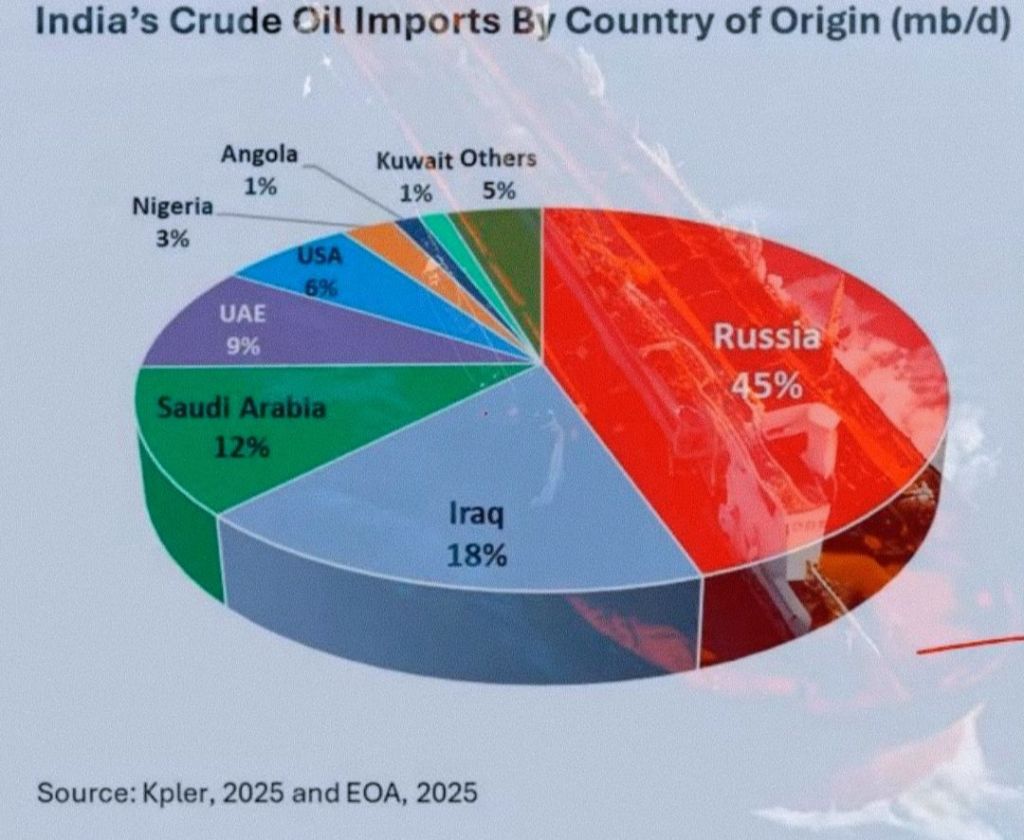

The numbers tell a compelling story. India imports close to 85% of its crude oil needs. When Russia—isolated and under Western sanctions—offered its oil at rates nearly $30 per barrel lower than market prices, India responded with economic precision. In less than two years, Russia moved from being a marginal supplier to India’s top source, now accounting for over 35% of the country’s oil imports. Indian refiners, leveraging this opportunity, processed the discounted crude into diesel and aviation fuel and exported them profitably. Not only did this help stabilize domestic fuel prices, it added strength to India’s foreign exchange reserves and kept inflationary pressures in check. In an era when global oil prices threatened to breach $130 per barrel, India’s energy strategy acted like a pressure-release valve—for itself and for the global market.

But in Washington, economic rationality doesn’t always override geopolitical calculations. During the Trump administration, the U.S. accused India of indirectly “funding Putin’s war” through its oil trade and issued veiled threats of imposing tariffs ranging from 25% to 100% on Indian exports. The irony, however, was difficult to ignore. India adhered to the G7 price cap and ensured its purchases were legally compliant. Still, while nations like China and Turkey continued their deepening trade with Moscow without similar scrutiny, India was singled out for criticism. To many in Delhi, this appeared less like enforcement of global norms and more like selective pressure wrapped in a narrative of moral policing.

Worsening matters was the tone of the diplomatic engagement. The Trump administration’s posture toward India often oscillated between patronizing and transactional. From taking public credit for India-Pakistan ceasefires to cosying up to Islamabad’s military establishment, Washington’s inconsistency left New Delhi wary. Analysts are beginning to draw comparisons to the 1971 Nixon-Kissinger era, where India’s sovereignty came head-to-head with American strategic rigidity. Then it was the Indo-Pak war; today, it’s energy security. The tension is no less combustible.

Complicating the scenario further was the impact on Indian companies. Nayara Energy, partly owned by Russian oil giant Rosneft, faced challenges as a result of EU sanctions, leading to stalled shipments. At the same time, there were murmurs from Washington suggesting potential penalties on Indian banks facilitating rupee-rouble oil transactions. The message was subtle but unmistakable—this is not just about barrels; it’s about geopolitical alignment and control.

Yet, India’s response has been calibrated, firm, and rooted in principle. The Ministry of External Affairs made it abundantly clear that decisions related to energy procurement are based on national interest, affordability, and strategic necessity. Noted, Former foreign secretary underlined that defending against undue foreign influence in core sectors like energy is not merely a choice—it is a sovereign obligation.

India is not blind to the long-term dynamics. It recognizes that diversification is the key to resilience. If U.S. sanctions on Iran and Venezuela were to be relaxed, India could quickly re-establish procurement lines from those countries. Concurrently, more stable supply arrangements from the Gulf, Africa, and even the U.S. are already being explored. The emphasis is on constructing a flexible, multi-source energy ecosystem. Russian contracts remain part of the strategy—not out of loyalty, but to retain leverage in negotiations.

On the domestic front, India is scaling up its refining capacities. Expansions like the Jamnagar refinery are future-proofing the nation’s energy infrastructure. On the international stage, India is strengthening ties within BRICS and the Global South—positioning itself among a bloc of nations that favour multipolar decision-making over Western-dominated consensus.

Notably, India is not looking to sever ties with Washington. Far from it. Expect quiet diplomacy behind closed doors, pragmatic tapering of Russian imports, and renewed strategic dialogues with the U.S. centred around shared interests—especially in countering China, fostering semiconductor cooperation, and advancing clean energy technology.

What India is doing is not rogue—it is rational. Russian crude may be inexpensive, but the larger cost lies in managing diplomatic expectations. Thus far, India has handled the situation with finesse, drawing maximum economic benefit while carefully navigating geopolitical minefields.

The core lesson here is one of sovereign strategic autonomy. It is rarely neat, often uncomfortable, and sometimes smells like diesel. But in a world defined by unpredictable alliances and shifting power centres, India is no longer playing the role of a passive recipient. It is shaping its own narrative.

Because in today’s geopolitical chessboard, India is not a pawn—it is a power. And it knows better than most: in the 21st century, energy is not just a commodity—it is leverage.

Visit arjasrikanth.in for more insights