While the world debated crypto and contactless cards, India built a digital money protocol so slick, so democratic, and so wildly interoperable—it became the envy of tech titans.

In a land where government files move slower than molasses and potholes celebrate birthdays, something truly bizarre happened. India pulled off a digital miracle that stunned the world—not in labs, not in think tanks, but in kirana stores, vegetable markets, weddings, and WhatsApp groups. And no, it wasn’t an AI that predicts the next family feud. It was UPI—Unified Payments Interface—a fintech rocketship that didn’t just launch; it broke the sound barrier of global imagination.

Before UPI arrived like a pajama-wearing, code-slinging messiah, digital payments in India were like fax machines with Wi-Fi: clunky, inconvenient, and full of forms that made you want to cry. NEFT and RTGS were great, as long as you enjoyed bank timings and had time to kill. IMPS was real-time, but felt like solving Sudoku blindfolded—account numbers, IFSC codes, and the constant fear of transferring money into financial oblivion.

Then UPI entered the room. No grand fanfare. No big launch party with laser lights. Just a quiet revolution, built by the National Payments Corporation of India (NPCI), released in 2016 like a stealth fintech ninja. Suddenly, sending money was easier than sending memes. A handle like yourname@bank replaced the digital chaos. And guess what? You didn’t even need your bank’s app. You could pick Google Pay, PhonePe, Paytm—or switch between them like changing your ringtone.

But this wasn’t magic pulled from a hat. It was years of layered digital groundwork. First, Jan Dhan gave millions their first bank account. Then Aadhaar stitched them into the system with a unique ID. Then came Jio, flooding the country with cheap internet. And finally, the chaotic plot twist called demonetisation that shoved cash under the bed and users into the warm, QR-embraced arms of digital payments. Waiting at the finish line was UPI.

UPI wasn’t another app. It was a protocol. Like electricity or water, but more reliable. It didn’t care if you were rich or poor, iPhone user or feature phone loyalist. With the flick of a thumb, it moved money—anytime, anywhere. While arguing over the price of bhindi. It became second nature, almost invisible. The best tech often is.

And then came scale. Not just millions. Billions. By 2025, UPI was clocking over 18 billion transactions a month. That’s more daily activity than all Amazon checkouts, Starbucks swipes, and Silicon Valley flexes combined. This wasn’t catching up to the West. This was leapfrogging it while sipping chai.

What makes UPI truly revolutionary, though, is a beautifully boring word: interoperability. Unlike the U.S., where Venmo and Zelle act like exes who don’t speak, or China’s app gardens locked tighter than your grandma’s Godrej cupboard, UPI is universal. My Paytm talks to your BHIM. Your PhonePe talks to my CRED. Everyone speaks the same money language.

This open protocol architecture is what turned India into a global fintech showcase. The IMF gushed. Nations queued up for the blueprint. Singapore integrated it. France flirted with it. And Silicon Valley just stared in disbelief. Because India—the land of late trains and later file approvals—had created a system faster, leaner, and smarter than anything in their sandbox.

But every Indian tale needs a twist. And here it is.

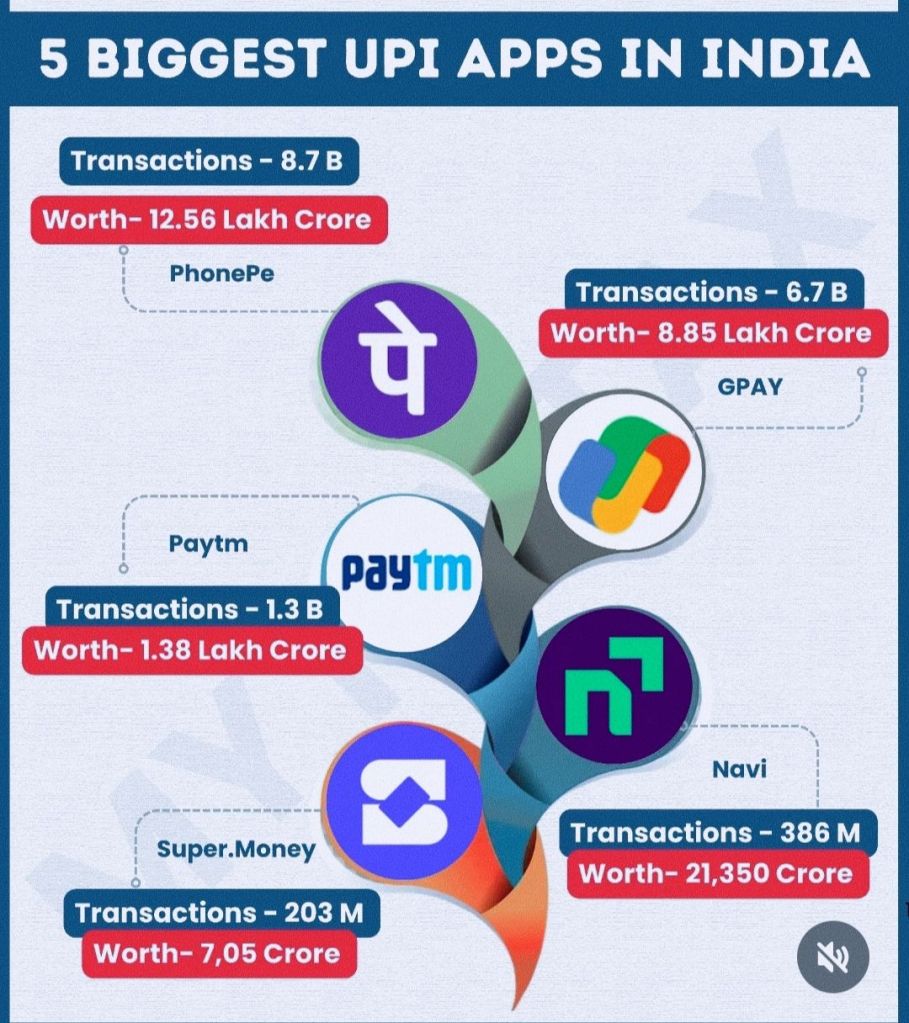

The very openness that made UPI glorious is under quiet threat. Two apps—PhonePe and Google Pay—now handle more than 85% of UPI’s traffic. Monopolies are slipping in through the side door. Exclusive cashback schemes, private QR codes, and app-specific rewards are fragmenting the once-borderless utopia. RBI had to step in like a stern parent at a noisy party: “Play fair or we’re turning off the internet.”

This concentration risks turning UPI into what it was built to destroy—a club with a dress code. Innovation stalls. New players struggle. And that free, open, email-like joy starts feeling like another branded walled garden.

Still, let’s not forget what’s been achieved here. India didn’t just digitize its economy—it redefined what digital inclusion looks like. From coconut vendors in Kerala to boutiques in Gurgaon, people scan, pay, smile, and move on. No drama. No receipts. No passwords. Just beep and done.

And this wasn’t limited to cities. Rural adoption boomed, thanks to voice-enabled UPI 123Pay and offline options like UPI Lite. Today, whether you’re a startup in Bengaluru or a shepherd in Rajasthan, your money moves at the speed of thought.

Globally, UPI isn’t just a case study. It’s becoming a template. Countries from Southeast Asia to Africa are replicating it. Economists hail it. Governments want it. Tech giants envy it. And yet, in India, it’s already become so embedded, so seamless, we barely notice it. That’s its greatest achievement—and perhaps its biggest risk.

Because in a country where building a road takes a decade and getting a stamp takes divine intervention, UPI happened not with chaos, but with clarity. It succeeded not because of jugaad, but because for once, everything actually worked.

So the next time you scan a QR code for ₹20 chai, remember: you’re holding the future in your hand.

And that future didn’t come from a VC in California.

It came from India, quietly humming at 18 billion transactions a month—with zero drama and infinite swagger.