“Silicon Sutras: India’s MedTech Metamorphosis into a Bionic Superpower”

India’s medical implants industry is rapidly evolving beyond traditional roles of healing bones and arteries, emerging as a dynamic force that is reshaping the future of healthcare through cutting-edge materials, advanced polymers, artificial intelligence, and bold innovation. Valued at an impressive $6.36 billion in 2024, the sector is poised for exponential growth, expected to reach $11.37 billion by 2033 with a robust compound annual growth rate (CAGR) of 6.18%. This surge represents more than just market expansion—it signals a transformative shift in how India engages with global healthcare technology, transitioning from a major importer of medical devices to a self-reliant, globally competitive manufacturer of advanced implants.

At the heart of this growth lie orthopaedic and cardiovascular implants, projected to constitute a $4.5 to $5 billion market by fiscal year 2028. Indian hospitals increasingly rely on these state-of-the-art devices—from hip and knee replacements to pacemakers and stents—to serve a rapidly aging and health-conscious population. With over 100 million elderly citizens, demand for joint replacements, spine interventions, and cardiac care has soared, reflecting both the demographic opportunity and an urgent medical necessity driven by rising chronic and lifestyle diseases. The goal of the industry is not merely restoration of function but enhancement: enabling patients to live longer, recover faster, and regain quality of life with smarter, more durable implants.

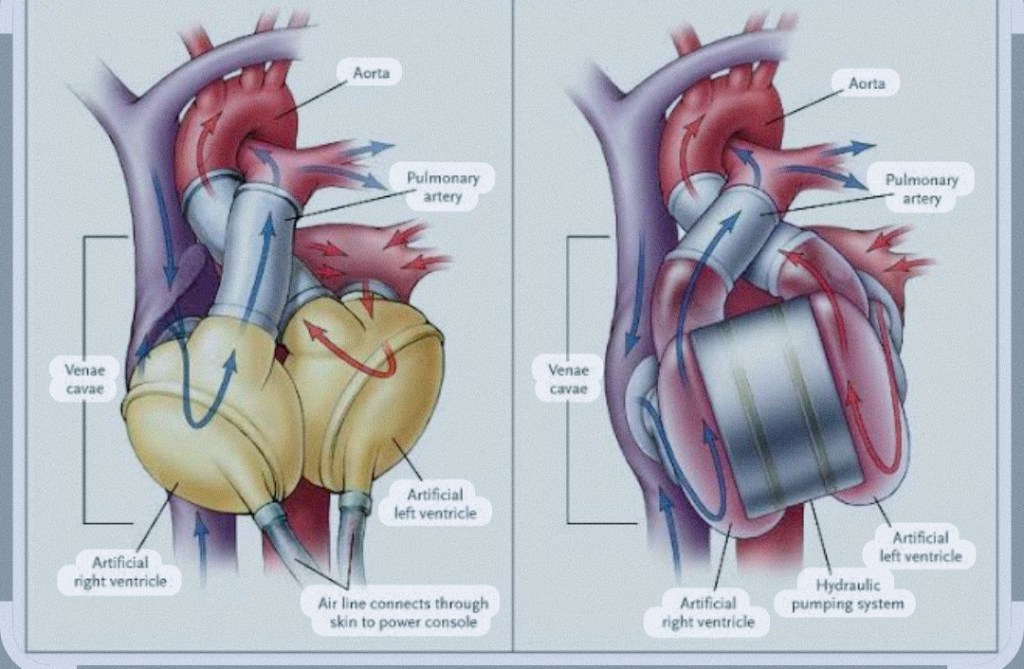

Orthopaedic implants remain the backbone of this industry, including devices for hips, knees, spines, joint reconstruction, and trauma repair. Cardiovascular implants such as drug-eluting stents, pacemakers, defibrillators, and heart valves have become indispensable tools in extending life expectancy. Beyond these core areas, the sector encompasses a broad range of products including dental implants, neurostimulators, ophthalmic devices, and cosmetic implants—demonstrating its widespread penetration and diverse applicability across medical disciplines.

India’s distinctive strength lies in the diversity of materials and technologies employed. Titanium alloys and stainless steel provide structural integrity, while polymers like PEEK and UHMWPE contribute flexibility. Advanced ceramics such as zirconia enable precision, and natural biomaterials including collagen enhance biocompatibility. These materials combine to create implants that are not only durable and functional but increasingly intelligent—integrating with the human body to deliver enhanced longevity and performance.

The growth trajectory, while nationwide, exhibits regional strengths: South India leads with world-class healthcare infrastructure and premier medical colleges; North India, particularly the National Capital Region, capitalizes on burgeoning medical tourism; West India hosts major manufacturing hubs in Maharashtra and Gujarat; and East India, traditionally underrepresented, is emerging as a promising frontier.

Multiple factors propel this growth. India’s expanding middle class, rising healthcare expenditures, improved insurance penetration (currently covering about 30% of the population), and government initiatives like Ayushman Bharat have democratized access to advanced implant care. Technological innovations are equally impactful, with India pioneering the development of 3D-printed implants, AI-powered diagnostics, smart implants capable of real-time health monitoring, and bioresorbable devices designed to dissolve once their function is complete. The sub-sector of microelectronic implants is growing at an accelerated pace of 8.5% CAGR and is projected to reach $2.2 billion by 2030.

Policy reforms and economic incentives have injected further momentum. The sector benefits from 100% Foreign Direct Investment (FDI) allowance, Production Linked Incentive (PLI) schemes encouraging domestic manufacturing, and the National Medical Device Policy 2023, all aimed at advancing the Atmanirbhar Bharat (self-reliant India) vision in MedTech. Importantly, price caps on essential devices are designed to keep life-saving technologies affordable and accessible to millions.

A noteworthy development is the renaissance in local manufacturing. Indian producers are growing at a blistering 28% CAGR—more than twice the growth rate of multinational corporations operating domestically. Pharmaceutical giants such as Zydus and Alkem entering the implants space underscore the sector’s rising prominence. Domestic implants cost 20-30% less than imported equivalents, offering a critical price advantage without compromising quality. Once heavily reliant on imports for nearly 85% of its medical devices, India is steadily reversing this trend through focused localization, innovation, and affordability.

Digital transformation is also reshaping patient care and aftercare. Telemedicine, AI-powered diagnostics, and digital health platforms have revolutionized the patient journey from initial diagnosis through recovery. These technologies are expanding access to specialized care in Tier 2 and Tier 3 cities, bridging the urban-rural divide and unlocking vast new markets in underserved regions.

Despite these positives, challenges remain. Regulatory changes under the Medical Device Rules create temporary bottlenecks. Price controls, while socially beneficial, may limit manufacturer margins. Dependence on imported components for high-tech devices persists, and ambiguities in intellectual property rights occasionally inhibit innovation. Infrastructure deficits in rural healthcare and a shortage of trained professionals for complex implant surgeries call for stronger public-private partnerships in medical education and skill development.

Looking ahead, the outlook for India’s medical implants industry is decidedly optimistic. With market size projected to exceed $11 billion by 2033 and exports expected to surpass the current $3.8 billion in MedTech, India stands poised to become a global leader. Achieving this will require strategic investments in R&D to develop tailored, cost-effective solutions; streamlined regulatory processes; stronger intellectual property frameworks; and expansion of healthcare services and training into the hinterlands.

India’s journey from a medical device consumer to a creator is no longer aspirational—it is a tangible reality being forged in titanium and programmed with silicon. This industry is not simply about replacing damaged parts; it is about building enhanced, smarter healthcare solutions that integrate deeply with the human body and the nation’s future. The Indian medical implants sector is evolving from strength to strength, becoming an intrinsic part of India’s healthcare core and its global healthcare identity.

Visit arjasrikanth.in for more insights