Milking the Potential: Decoding the Disparity Between Amul’s Triumph and Vijaya Dairy’s Struggles in India’s White Revolution”

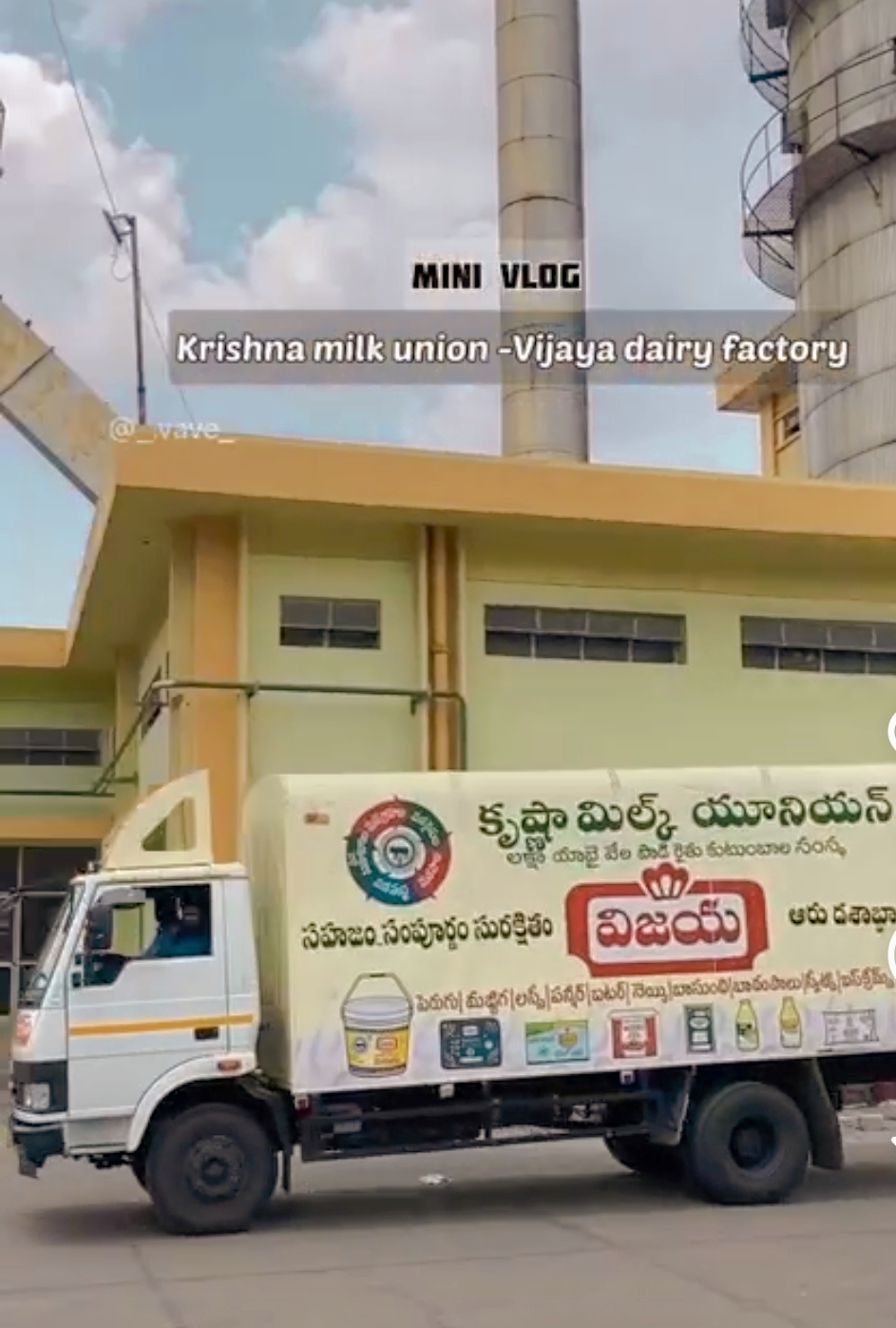

India’s dairy sector stands not just as an economic pillar but as a cornerstone of rural livelihoods, nourishing households and energizing local economies. Among the success stories, the iconic Amul dairy cooperative from Gujarat has emerged as a national model of operational excellence, whereas its counterpart in Andhra Pradesh, Vijaya Dairy, remains mired in structural inefficiencies that inhibit its true potential. Yet, beneath these challenges lies a compelling opportunity for transformation. A comparative analysis of Amul’s operational model reveals a strategic pathway through which Vijaya Dairy could reposition itself as a competitive force in the national dairy landscape.

Amul’s remarkable success is deeply rooted in its robust three-tier cooperative framework encompassing Village Dairy Cooperative Societies, District Unions, and a State Federation. This architecture fosters both efficiency and farmer empowerment. By contrast, Vijaya Dairy’s procurement system remains disjointed, with weak linkages between farmers and cooperatives. Delayed payments and a lack of transactional transparency deter farmer participation, while irregular milk collection and insufficient cold storage infrastructure exacerbate quality deterioration and spoilage—losses that could be mitigated through systemic enhancements.

Amul’s processing capabilities reflect world-class standards, with modern facilities operating at a high capacity utilization of 80–90%. Its diversified product portfolio—ranging from basic dairy to premium items like cheese, chocolates, and ice creams—ensures multiple revenue channels and robust market positioning. In comparison, Vijaya Dairy operates well below optimal capacity, with processing efficiencies hovering around 50–60%. Its reliance on basic products like liquid milk and curd, coupled with manual packaging methods, increases both operational risk and contamination potential.

On the marketing front, Amul’s strong brand equity, bolstered by innovative campaigns and a nationwide distribution framework, ensures ubiquitous market presence. Vijaya Dairy, however, lacks visibility beyond Andhra Pradesh. With limited brand investment and distribution hurdles—especially in underserved rural markets—its reach and consumer resonance remain restricted.

Financial resilience further differentiates the two entities. Amul’s scale, pricing strategies, and consistent farmer incentives contribute to its long-term sustainability. Vijaya Dairy, in contrast, remains heavily reliant on government subsidies, a dependency that fosters inefficiencies and undermines farmer engagement. The absence of financial autonomy translates into inconsistent milk supply and fragile operational stability.

Several core factors underpin Amul’s edge. Its grassroots-oriented cooperative governance fosters a sense of ownership among farmers, a quality largely absent in Vijaya’s top-down administrative model. Amul’s early and aggressive adoption of digital and automation technologies—including IoT-enabled milk testing, automated processing, and cashless payments—enables precision and efficiency. Vijaya’s delayed tech adoption hampers its competitiveness. Amul’s consumer-centric strategy facilitates market-responsive innovation, whereas Vijaya is stuck in a production-driven mindset. Moreover, Amul benefits from agile, corporate-style leadership, in contrast to Vijaya’s bureaucratic inertia.

To unlock its latent potential, Vijaya Dairy must embrace a structured roadmap for transformation. Reinforcing grassroots cooperative structures is critical. Revitalizing village-level dairy societies, enabling democratic farmer representation, and digitizing payment mechanisms will strengthen producer trust and participation. Increasing milk collection frequency and investing in decentralized chilling infrastructure will mitigate wastage and improve product quality.

Equally essential is the modernization of processing facilities. Integrating automation can raise efficiency, while diversifying into value-added products—such as flavored milk, probiotic curds, and packaged dairy snacks—can boost margins and consumer appeal. Deploying AI-driven quality control systems will further ensure product consistency and enhance market credibility.

Branding and distribution strategies must be reimagined with a sharper, more contemporary identity. Repositioning Vijaya as a symbol of regional pride—perhaps under a banner like “Pure Andhra Pride”—can forge stronger emotional connections with consumers. Digital marketing, e-commerce channels, and strategic alliances with retail chains can vastly extend market penetration.

Reducing fiscal dependency on government support is imperative for sustainable growth. Vijaya should consider introducing performance-linked incentives to drive staff accountability, encouraging private investment through public-private partnerships for infrastructure upgrades, and appointing professional management for streamlined decision-making. Tapping into resources from the National Dairy Development Board and integrating blockchain for supply chain transparency will further fortify operational integrity.

Vijaya Dairy has the ingredients required to evolve into a dynamic, profitable, and self-reliant enterprise. A comprehensive strategy anchored in farmer empowerment, technological modernization, financial prudence, and brand reinvention can catalyze this transformation. The time to act is now.

By initiating reforms such as digitized payments, piloting new product lines, upgrading plants, and fortifying the cold chain, Vijaya Dairy can script a turnaround. The vision should not be limited to survival but aimed at leadership in India’s fast-evolving dairy sector, thereby ensuring sustained benefits for producers, consumers, and the broader rural economy.

Visit arjasrikanth.in for more insights