Governance Gaps and Systemic Failures Drive Wealth Creators to Seek Greener Pastures Abroad

In the intricate web of Indian governance, a glaring paradox stands out: while the government relentlessly pursues tax collection, it consistently falters in delivering the quality public services that justify such financial demands. This disconnect is particularly glaring for the wealth creators and high-income earners who play a pivotal role in driving the nation’s economy. Trapped in a frustrating cycle of paying exorbitant taxes but receiving inadequate public services in return, they are increasingly left wondering whether their contributions are being put to meaningful use.

This disparity raises an essential question: why does the government, so eager to extract revenue, not demonstrate the same enthusiasm in ensuring robust public infrastructure and services? The frustration of wealth creators has reached a tipping point, leading many to explore greener pastures abroad. Their decisions are not impulsive acts of disloyalty but reasoned choices influenced by the stark differences in governance quality, infrastructure, and economic opportunities offered by other nations.

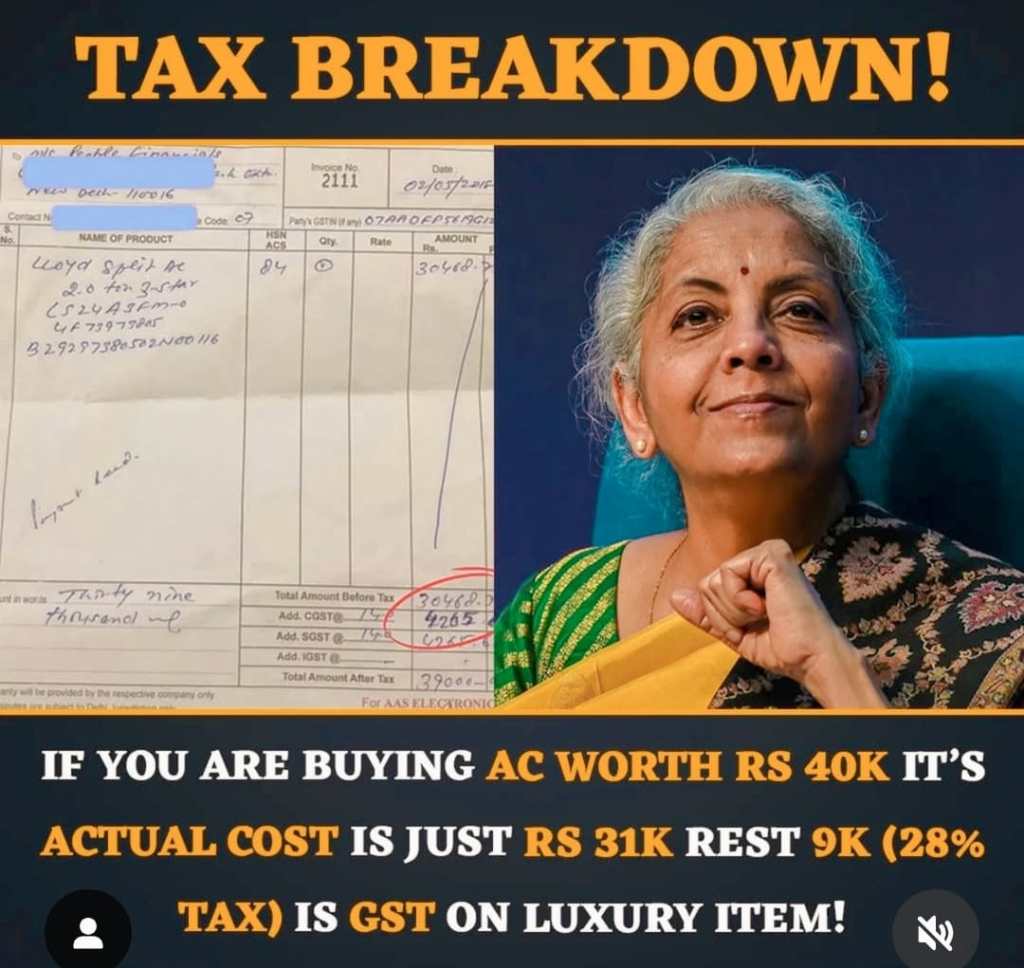

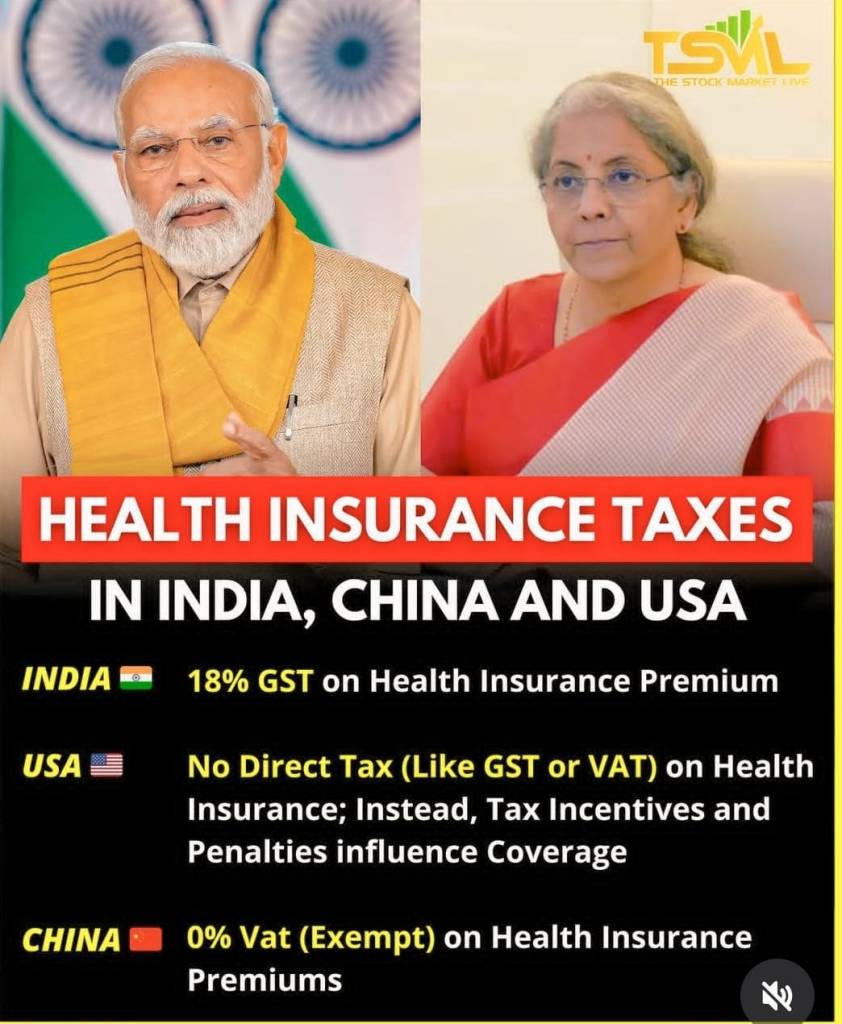

High taxes in India—peaking at a maximum rate of 39%, with surcharges pushing the effective rate even higher—are among the steepest globally. These taxes represent a significant contribution from the affluent, yet what they receive in return often feels underwhelming. Public infrastructure is riddled with inefficiencies, public transport systems are chaotic, and roads are plagued by potholes. Such conditions compel many to double-pay for services—once through taxes and again by turning to private solutions for healthcare, education, and even basic utilities like water and electricity.

This dual burden fosters a sense of inequity and resentment, as many feel they are unfairly penalized for their success. While other nations offer better infrastructure, transparent systems, and a predictable business environment, India’s wealth creators find themselves in an environment that often hinders rather than supports their ambitions.

Failures in governance exacerbate the problem. For instance, the state’s inability to effectively manage urban water crises or public transportation systems forces private enterprises to step in. However, instead of facilitating these efforts, the government often imposes regulatory barriers that stifle innovation and efficiency. This pattern—where private solutions to systemic issues are obstructed by state interventions—further erodes trust and confidence in public institutions.

At the core of these failures lies the inability to protect basic property rights, a fundamental responsibility of any competent state. India’s land ownership landscape is a labyrinth of unclear titles, overlapping claims, and protracted legal battles. This legal limbo undermines the ability of citizens to leverage their assets effectively and adds to the frustrations of doing business in the country. Comparatively, nations like Singapore and the UAE combine robust property rights, efficient judicial systems, and reliable public services with lower tax burdens. These attributes make them highly attractive to India’s wealth creators.

Critics of affluent individuals who relocate often argue that they owe their success to India’s system and are therefore morally obligated to contribute more. However, this argument oversimplifies a complex issue. Many of these individuals succeed despite the system, not because of it. They must navigate bureaucratic red tape, inefficiencies, and corruption to achieve their goals. Additionally, the notion that low-cost domestic labor offsets these challenges ignores the systemic unemployment and underemployment that drive such conditions. True progress lies not in excessive taxation but in fostering an environment conducive to innovation, entrepreneurship, and economic mobility.

The growing exodus of wealth creators signals a deeper malaise in the system. Their migration is not merely an economic loss but also a significant missed opportunity for India’s development. These individuals take with them their entrepreneurial spirit, innovative ideas, and substantial investments—assets that could have fuelled growth and global competitiveness. The government must recognize this as a wake-up call to address inefficiencies, corruption, and the lack of transparency that push these individuals to seek opportunities elsewhere.

Public discourse around this issue is vital. Wealth creators who choose to leave are often vilified as unpatriotic, but their decisions are rooted in rational self-interest rather than disloyalty. Their migration should be viewed as a protest against systemic failures and a call for reform. Addressing the root causes of their dissatisfaction can not only stem this exodus but also strengthen the foundation for a more equitable and prosperous society.

This is not merely a question of accountability to the wealthy; it is a broader issue of governance that affects all citizens. The government’s inability to deliver basic services undermines public trust and perpetuates a cycle of inefficiency and dissatisfaction. Citizens have every right to demand better returns on their tax contributions. Instead of perpetually shifting the burden onto high earners, the state must prioritize reforms that ensure efficiency, transparency, and equity in public service delivery.

The irony of “paying more, getting less” encapsulates the frustrations of many Indians, not just the affluent. It underscores the urgent need for systemic change. Investments in infrastructure, improvements in public service delivery, and the protection of property rights are not optional; they are fundamental to the nation’s progress. Without these reforms, India risks losing not only its wealth creators but also its broader economic potential.

Ultimately, the decision to migrate is a deeply personal one, often driven by a desire for a better quality of life, transparent governance, and opportunities aligned with individual aspirations. Instead of vilifying those who leave, their departures should serve as a catalyst for introspection and meaningful reform. Retaining talent and fostering a supportive environment for wealth creators is not just a matter of national pride but an essential strategy for sustainable development.

If the government can confront these systemic failures and implement meaningful reforms, India can reverse this trend and unlock its full potential. Until then, the irony of India’s tax paradox will continue to drive its brightest and best to seek opportunities elsewhere, leaving behind a system that struggles to meet even the most basic expectations.

Visit arjasrikanth.in /@DrArjasreekanth for more insights