“From NPA Turmoil to Operational Triumphs—The Decade-Long Transformation of Public Sector Banks”

In the labyrinth of Indian finance, the tale of public sector banks (PSBs) over the last decade is one of revival and resilience. These banks, once drowning in an ocean of non-performing assets (NPAs), have emerged as harbingers of a new era in financial stability. Yet, this transformation has been far from straightforward, demanding meticulous strategies and unwavering reforms to address systemic inefficiencies.

The menace of NPAs once loomed large, threatening the very stability of PSBs. Defaulted loans, which crippled operational efficiency and capital reserves, became a ticking time bomb. To counter this crisis, banks employed a variety of recovery tactics, from restructuring loans to transferring stressed assets to Asset Reconstruction Companies (ARCs). The government and the Reserve Bank of India (RBI) stepped in with sweeping reforms to mitigate the escalating financial risks. Central to this effort was the Asset Quality Review (AQR), a landmark initiative launched in 2015 under the stewardship of then-RBI Governor Raghuram Rajan. The AQR forced banks to confront their financial fragilities, exposing the alarming scale of bad loans—a significant increase in NPAs by FY16. This transparent diagnosis became the foundation for systemic recovery.

The government’s four-pronged strategy of “Recognition, Resolution, Recapitalization, and Reform” served as a guiding compass. Initially, banks were required to fully recognize and disclose their NPAs, stripping away years of obfuscation. Resolution followed with the advent of the Insolvency and Bankruptcy Code (IBC) in 2016, which revolutionized asset recovery. By ensuring time-bound resolutions and elevating recovery rates to over 40%, the IBC not only salvaged assets but also enhanced India’s global ease of doing business ranking. Additionally, tools like the SARFAESI Act and Debt Recovery Tribunals (DRTs) bolstered the legal framework, enabling banks to auction defaulters’ assets and expedite debt recovery.

Recapitalization played a crucial role in revitalizing PSBs. Between 2016 and 2021, the government injected an eye-popping ₹3.1 lakh crore into the banking sector. This capital infusion shored up financial health, while reforms in governance—led by initiatives like the establishment of the Bank Board Bureau (BBB)—ensured accountability and professionalized leadership. Parallel advancements, such as amendments to the Security Contracts (Regulation) Act and the creation of centralized public registries to track credit histories, added another layer of resilience to the system.

The Enhanced Access and Service Excellence (EASE) framework catalysed operational transformations. By promoting technology adoption, strengthening human resource management, and institutionalizing robust risk practices, EASE has equipped banks to better navigate crises. Specialized verticals for stressed asset management and early warning systems to detect emerging NPAs reflect the sector’s growing maturity.

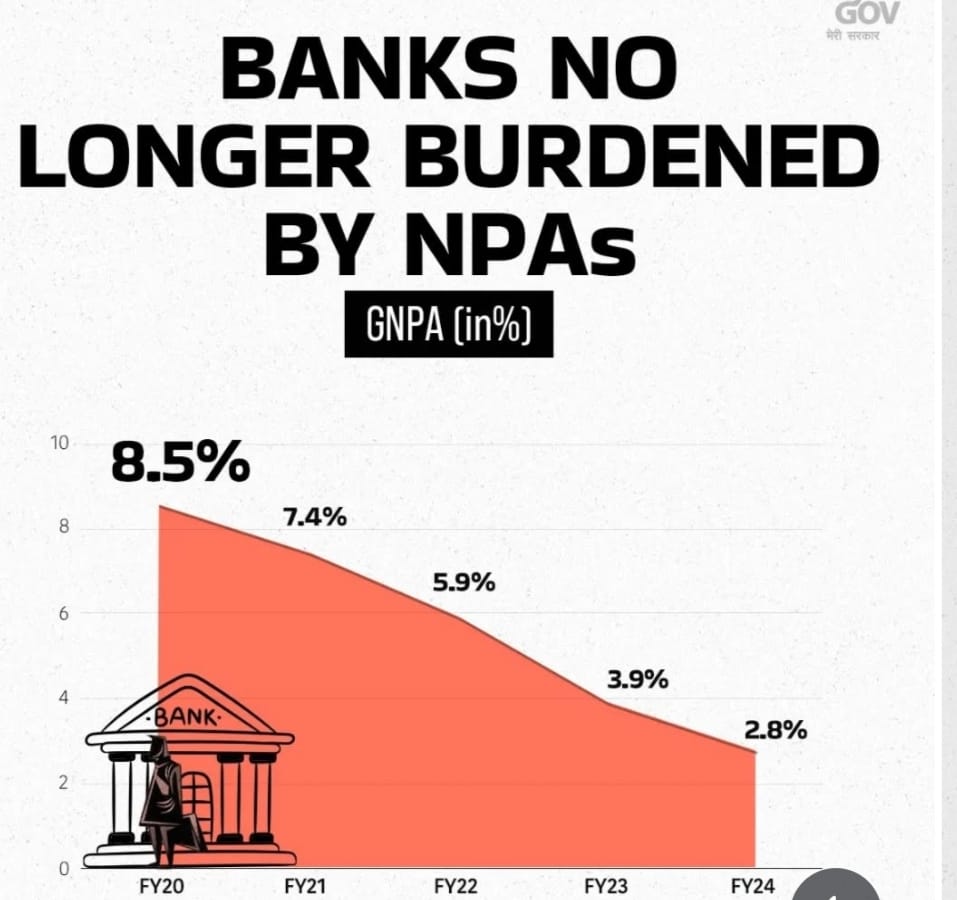

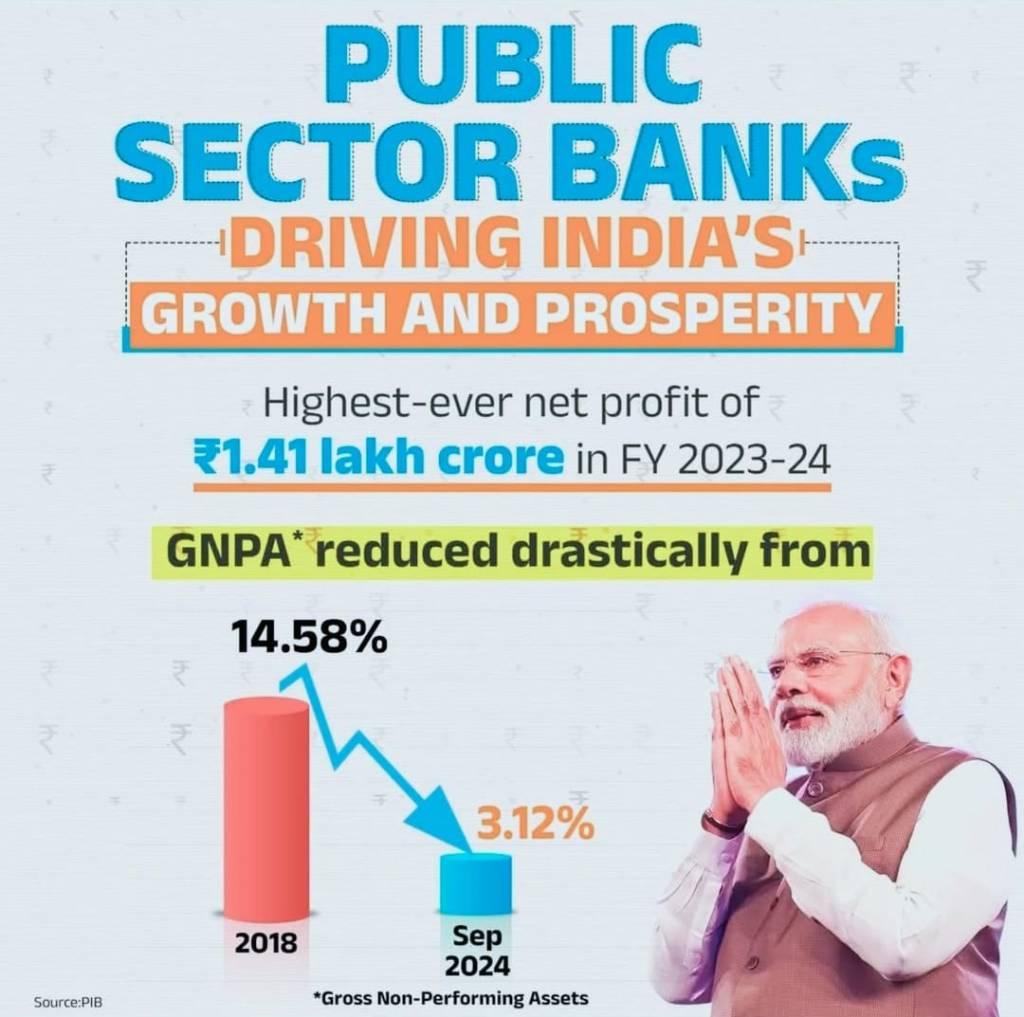

The results of these herculean efforts are undeniable. From a peak NPA ratio of 14.6% in FY18, PSBs have clawed their way to a manageable 5.2% in FY23. This dramatic decline is not merely a statistical victory but a testament to the government’s and RBI’s collective resolve. However, stability in banking is an elusive goal. As PSBs pivot towards unsecured retail lending—targeting products like personal loans and credit cards—new risks are emerging. While retail loans are a promising growth avenue, their unsecured nature renders them susceptible to defaults, potentially igniting a fresh credit cycle. This shift underscores the imperative for banks to strike a delicate balance between growth and prudence.

Operational transformations in India’s public sector banks (PSBs) have been significantly bolstered by the Enhanced Access and Service Excellence (EASE) framework. This initiative prioritized technology adoption, strengthened human resource management, and institutionalized robust risk practices. Specialized verticals for stressed asset management and early warning systems underscore the sector’s growing maturity.

The results are striking: the peak NPA ratio of 14.6% in FY18 has dropped to 5.2% in FY23, a testament to the government’s and RBI’s resolve. However, challenges persist as PSBs increasingly focus on unsecured retail lending, such as personal loans and credit cards. While this segment offers growth potential, its unsecured nature raises the risk of defaults, potentially triggering another credit cycle. This underscores the importance of maintaining a balance between growth and prudent risk management to ensure long-term stability in India’s banking sector.

The story of India’s public sector banks over the past decade is one of resilience and recovery, underscored by strategic interventions and reforms aimed at addressing long-standing inefficiencies. As the banking sector continues to evolve, the focus must remain on maintaining stability while navigating the complexities of a rapidly changing financial landscape. The lessons learned from past challenges will be instrumental in shaping the future trajectory of public sector banks, ensuring that they remain robust and responsive to the needs of the Indian economy.

Visit arjasrikanth.in / @DrArjasreekanth for more insights

One response to “Banks: From Breakdowns to Breakthroughs in India’s Financial Saga”

Merry Christmas 🎅

LikeLike