“From Fuel to Food, Skyrocketing Prices and Shattered Markets—Why Global Tensions Could Burn Holes in Every Indian Wallet”

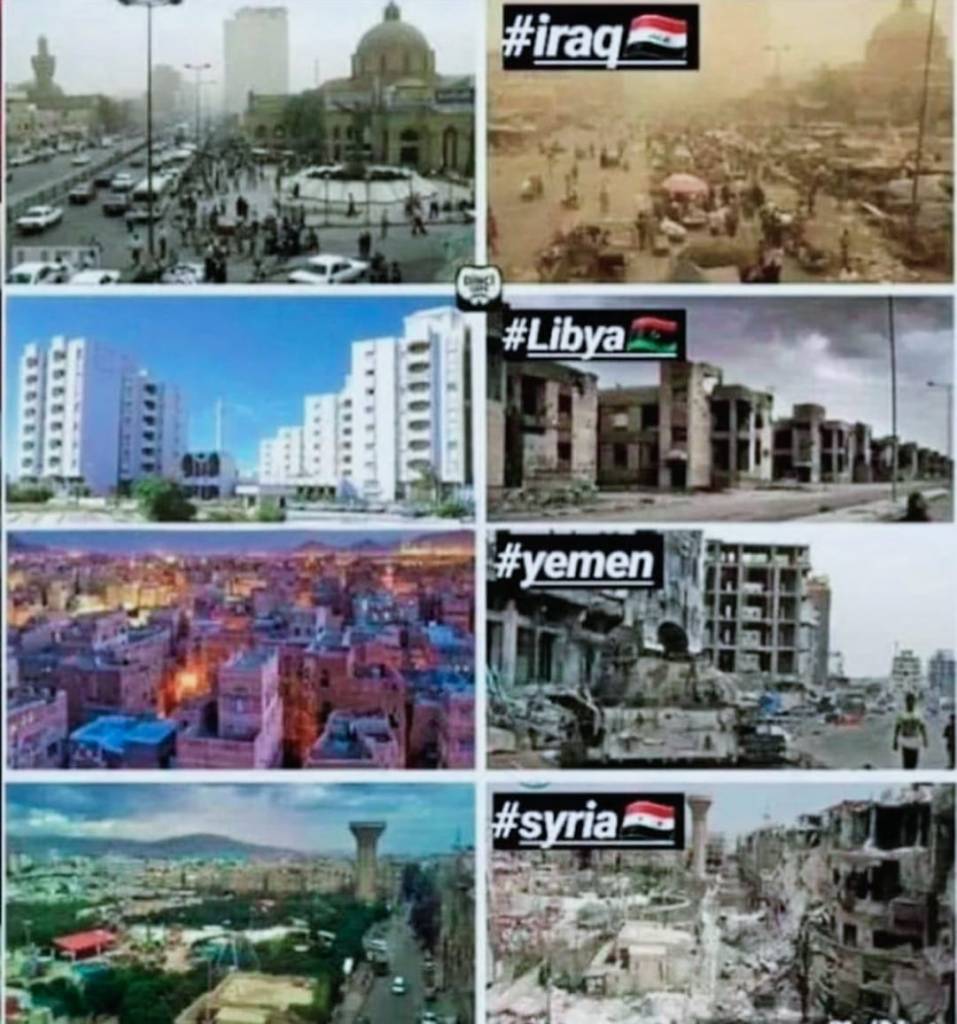

The Middle East, with its long history of geopolitical turmoil, continues to be a hotspot for tensions that extend far beyond the region’s borders. Among the many countries vulnerable to the fallout from conflicts in this area is India. Given its deep economic and strategic ties to the Middle East, India finds itself in a precarious position, particularly as tensions between Israel and Iran threaten to escalate into a full-scale war. The consequences for India could be severe, from disruptions in energy security to the livelihoods of millions of expatriates. A conflict of this scale would not only destabilize India’s economy but also profoundly affect the lives of its citizens.

One of the most significant factors placing India at risk is its heavy dependence on Middle Eastern oil. Approximately 80% of India’s oil is imported from this region, making any conflict there a direct threat to its energy supply. Should tensions escalate, oil prices could skyrocket, creating a ripple effect across the entire economy. Sectors that rely heavily on energy, such as manufacturing, plastics, and transportation, would experience rising production costs, which would inevitably be passed on to consumers. As the cost of goods and services increases, it would hit the average Indian household hard, pushing up inflation and squeezing disposable incomes.

The immediate impact of rising oil prices on India’s energy security cannot be understated. Higher oil prices would exacerbate the country’s current account deficit (CAD), as India would spend significantly more on imports while earning less from exports. This could lead to a devaluation of the rupee and soaring inflation, further driving up the cost of essential goods like food and fuel. For a nation already grappling with inflationary pressures, the effects could be devastating, especially for low- and middle-income households. As essential goods become less affordable, the economic strain would be acutely felt by millions.

Another critical concern for India in the event of a Middle Eastern conflict is the safety and livelihoods of the 9 million Indian expatriates working in Gulf countries. These workers send billions of dollars in remittances back to India each year, providing vital support to their families and contributing significantly to the national economy. Should a war break out, the safety of these expatriates would be at risk, potentially forcing many to return home. The loss of remittance inflows would further destabilize India’s economy, exacerbating financial pressures at a time when they are least needed.

Beyond these immediate economic concerns, India’s strategic investments in the region could also be jeopardized. One of the most significant is the Chabahar port in Iran, which India has developed as part of its efforts to secure a trade route to Central Asia, bypassing Pakistan. This port is of immense strategic importance, and any escalation in conflict could halt its operations, undermining India’s trade ambitions and weakening its geopolitical influence. The potential shutdown of Chabahar would represent a significant setback for India’s broader regional strategy.

India’s financial markets, too, would feel the effects of heightened volatility in the Middle East. Global stock markets are highly sensitive to geopolitical tensions, and a full-blown war in the region would send shockwaves through financial systems worldwide. Investors typically seek safer assets during periods of uncertainty, leading to capital outflows from emerging markets like India. Combined with rising inflation, this could stifle economic growth. With investor confidence shaken, many long-term development projects and infrastructure investments in India could face delays or even cancellation, compounding the country’s economic woes.

The broader economic forces at play further highlight the scale of the challenge. Oil is the lifeblood of modern economies, and India’s heavy reliance on Middle Eastern oil makes it particularly vulnerable to supply disruptions. Critical shipping routes such as the Strait of Hormuz or the Red Sea could become perilous in the event of war, threatening not only oil shipments but also broader trade flows. Recent trade statistics underscore the severity of the situation. India’s trade with nations like Iran has already plummeted by over 63%, a direct consequence of regional instability. Similar downward trends have been observed with other Middle Eastern nations, emphasizing the vulnerability of India’s economy to external shocks from the region.

Furthermore, India’s economic interdependence with the Gulf Cooperation Council (GCC) nations—which account for nearly 20% of its total trade—could also face severe disruptions. India’s exports to the Gulf, including machinery, pharmaceuticals, textiles, and petrochemical products, would be deeply affected by a prolonged conflict. These industries rely on stable supply chains and affordable energy, both of which would be at risk in a wartime scenario. The resulting cost increases could be passed on to consumers, driving inflation even higher and adding to the financial burden on Indian households.

The aviation sector, already one of the hardest hit by rising oil prices, would also face significant challenges. Airlines would likely raise ticket prices to cover higher operational costs, making domestic and international travel more expensive for Indian consumers. Additionally, geopolitical tensions could force airlines to alter their travel routes, further complicating operations and driving up costs.

For Indian manufacturers, the rising cost of production due to surging oil prices would have a cascading effect on a wide array of consumer goods, from electronics to packaged foods. These price hikes would hit Indian consumers hard, particularly as wage growth remains stagnant in many sectors. Households would need to adapt to this new economic reality by adjusting their spending habits, cutting back on discretionary purchases, and prioritizing essential goods.

In response to these looming challenges, the Indian government would need to act swiftly to stabilize the economy. Diversifying oil import sources and accelerating domestic energy production, particularly in renewables, would be crucial to reducing India’s dependency on volatile Middle Eastern energy markets. By bolstering its energy security, India could better insulate itself from future geopolitical shocks.

In conclusion, the escalating tensions between Israel and Iran, along with broader conflicts in the Middle East, have far-reaching consequences for India. From energy security to trade and remittances, the ripple effects would be felt across all segments of the economy, with average Indian households bearing the brunt of the impact. Policymakers must take proactive measures to safeguard the country from the worst effects of this potential conflict. By reducing reliance on Middle Eastern oil and diversifying energy sources, India can navigate this storm and emerge stronger on the other side.

Visit arjasrikanth.in for more insights