Blending Guaranteed Benefits and Market Growth for a Secure Retirement

In an era where financial stability is no longer a luxury but a necessity, the significance of pensions and social security looms larger than ever. For countless employees, the funds they contribute throughout their careers serve not merely as a financial obligation but as a promise of a stable and secure retirement. As individuals invest both their finances and trust into social security systems, it becomes crucial to ask: Is the government effectively managing these funds to ensure their growth and provide adequate benefits to retirees?

The recently introduced Unified Pension Scheme (UPS) by the Indian government aims to address this very concern. The UPS represents a critical reform in the pension system for government employees by combining elements of both the Old Pension Scheme (OPS) and the National Pension System (NPS). Unlike the NPS, which is a fully contributory scheme without guaranteed benefits, the UPS offers a mix of assured pension benefits along with the contributory nature of the NPS. This hybrid model is designed to balance fiscal prudence with the provision of financial security to government employees after retirement.

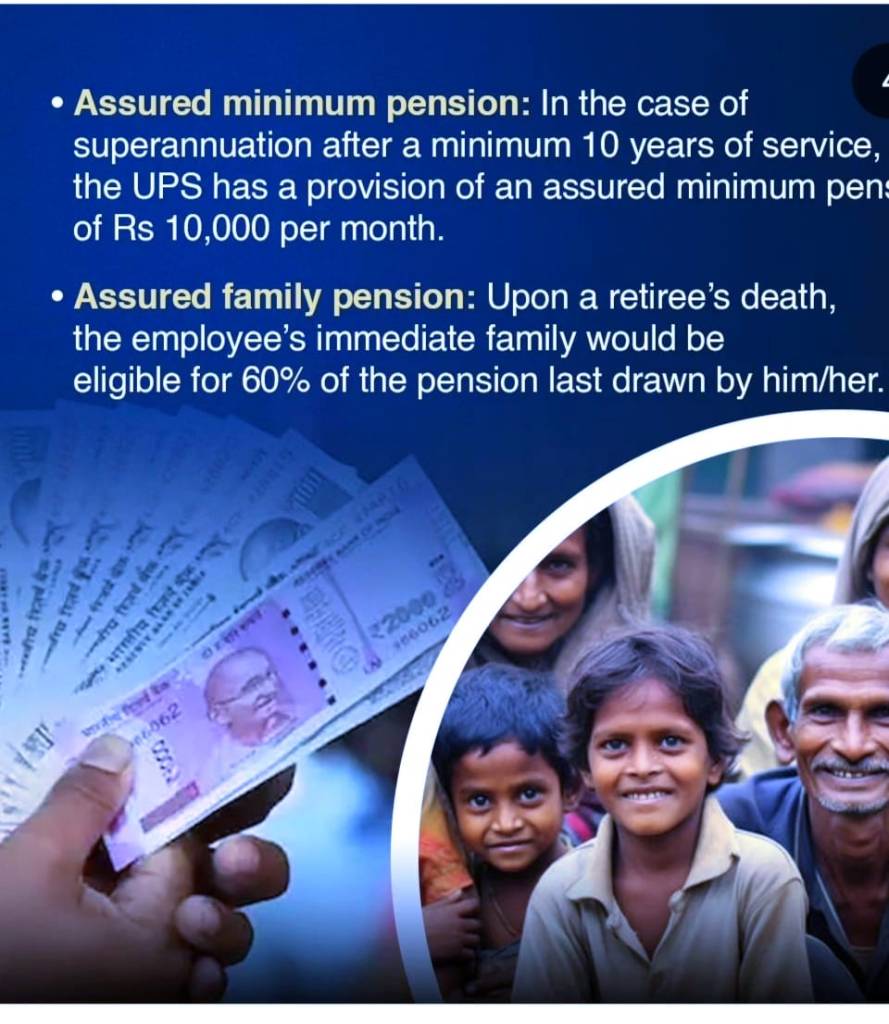

The UPS guarantees government employees a pension equivalent to 50% of their average basic pay from the last 12 months before retirement, provided they have a minimum of 25 years of service. For those with fewer years of service, the pension amount is proportional to their tenure, with a minimum qualifying service set at 10 years. This component mirrors the OPS by providing a defined benefit. Additionally, in the unfortunate event of an employee’s death, the scheme ensures that the spouse receives a family pension amounting to 60% of the employee’s pension. This provision mirrors the protection offered under the OPS and ensures financial security for the families of government employees.

Another significant feature of the UPS is its assured minimum pension and inflation indexation. All employees with at least 10 years of service are entitled to a minimum pension of ₹10,000 per month. Moreover, both the assured pension and family pension are adjusted for inflation, protecting the pension’s purchasing power against rising prices. Retirees also receive Dearness Relief, which is adjusted according to the All India Consumer Price Index for Industrial Workers (AICPI-IW), similar to current employees. Additionally, upon retirement, in addition to gratuity, employees receive a lump sum payment equivalent to one-tenth of their monthly emoluments (including pay and Dearness Allowance) for every six months of completed service. This payment is in addition to the assured pension and does not reduce its amount.

The introduction of the UPS marks a significant shift from the NPS, introduced in 2004, which represented a departure from the non-contributory OPS to a contributory pension system. Under the NPS, employees and the government contribute towards the pension fund, with employees contributing 10% of their basic pay and Dearness Allowance, while the government contributes 14% (with a proposal to increase this to 18.5%). The NPS, however, does not provide an assured pension amount; the returns depend on the market performance of the chosen investment schemes managed by various pension fund managers. The UPS, in contrast, retains the contributory structure of the NPS but integrates it with the assurance of defined benefits similar to the OPS. The key difference is that while the NPS is fully market-driven with no guaranteed returns, the UPS offers a hybrid model with guaranteed pension benefits and family pension, thus providing a more secure post-retirement financial outlook for employees.

The implementation of the UPS is expected to cost the Indian exchequer ₹800 crore in the first year and approximately ₹6,250 crore overall. Despite the higher initial expenditure, the UPS remains within the framework of a contributory funded scheme, which is crucial for maintaining fiscal sustainability. This contrasts with the OPS, which was an unfunded non-contributory scheme, posing significant long-term fiscal risks.

The UPS applies to all government employees who retired under the NPS from 2004 onwards. These retirees will have their pension arrears adjusted based on what they have already drawn under the NPS. Current employees can choose between continuing with the NPS or switching to the UPS, though once a choice is made, it is irreversible. While the UPS currently applies to central government employees, state governments have the option to adopt the scheme, potentially broadening its reach to more government employees across India.

Social security acts as a vital safety net for employees, assuring them of financial support in their post-retirement years. Each month, a portion of an employee’s salary is contributed to this fund, which is managed by the government. This money is not merely an expense; it is a strategic investment in the future. The effectiveness of this investment is heavily reliant on how well the government oversees and manages these funds. In recent years, there has been a growing concern regarding the adequacy of these management practices, particularly in light of the shifting dynamics surrounding pensions.

The National Pension System (NPS), introduced in 2004, marked a significant departure from the traditional defined benefit pension schemes. Under the NPS, the pension amount is directly tied to the corpus accumulated throughout an employee’s service. While this system sought to create a more sustainable pension model, it has come under fire for its heavy reliance on market performance and the absence of guaranteed returns for retirees. Employees have expressed concerns about the unpredictability of their future financial security, which has prompted discussions about reform.

The impending implementation of the Unified Pension Scheme (UPS) on April 1, 2025, signals a crucial acknowledgment from the government regarding the need for reform. This new scheme promises to provide an assured pension to 23 lakh eligible central government employees, representing a substantial shift in the government’s approach to pension management. However, this change comes with an increased financial burden, estimated at Rs 6,250 crore annually, raising questions about the sustainability of such commitments.

The UPS is designed to offer a more secure pension option for employees. Specifically, the government’s contribution will increase from 14 percent to 18.5 percent of the basic salary, while employee contributions will remain fixed at 10 percent. This increase aims to provide a more substantial pension pay-out, addressing long-standing demands from government employees for a more reliable retirement income. Notably, one of the key features of the UPS is its linkage to the length of service. Employees opting for this scheme will receive an assured pension of 50 percent of the average basic pay drawn over the last 12 months before retirement, offering a more predictable financial outcome for retirees. This level of assurance can significantly reduce anxiety about market fluctuations and investment risks that have plagued the NPS.

Despite the promising features of the UPS, various challenges lie ahead. The government’s ability to effectively manage and multiply pension funds is crucial for the success of this scheme. With a plethora of technological advancements and expertise available, the question arises: Why not leverage private sector capabilities for better returns? The government should consider establishing partnerships with private investment firms that have a proven track record in efficiently managing pension funds. Such collaborations could enhance the growth potential of pension funds and ensure that retirees receive the financial support they deserve.

Moreover, the government must maintain transparency regarding the costs associated with pension schemes. As the UPS is poised to impose an additional financial burden on the exchequer, it is essential to communicate this clearly to taxpayers. The implications of increased taxation to support these schemes should also be addressed in public discussions, allowing citizens to understand the broader economic landscape in which these decisions are made.

Technological advancements present numerous opportunities for optimizing pension fund management. Utilizing data analytics can provide valuable insights into market trends, aiding in making informed investment decisions. Furthermore, adopting innovative investment strategies—such as impact investing or sustainable investing—can yield better returns while also benefiting society. These approaches have the potential to align the objectives of pension funds with broader social and environmental goals.

The private sector has demonstrated its capability to effectively manage pension funds, often achieving higher returns than those typically realized by government-managed funds. By allowing private organizations to manage a portion of the UPS funds, the government could increase the likelihood of providing better returns to retirees. This shift could foster a more competitive environment, driving innovation and efficiency in pension fund management.

As the landscape of pension schemes evolves, it is essential for employees to be educated about their options. Understanding the implications of opting into the UPS versus remaining under the NPS empowers employees to make informed decisions about their financial futures. Educational initiatives—such as workshops, seminars, and easily accessible resources—can help demystify these complex systems, ensuring that employees are well-informed about their choices.

The political ramifications of the UPS cannot be overlooked, as this scheme has generated significant buzz in the political arena. The NDA government has framed the UPS as a proactive step towards enhancing the welfare of government employees, which has the potential to influence voter sentiment, particularly among public sector workers. The ability to communicate effectively about this scheme’s benefits and its impact on government finances will be essential for the government to garner public support.

In conclusion, the introduction of the Unified Pension Scheme marks a significant milestone in India’s approach to securing the future of its government employees. By balancing elements of the Old Pension Scheme and the National Pension System, the UPS addresses long-standing concerns about pension security while ensuring fiscal responsibility. However, its success will depend on the government’s ability to manage pension funds effectively, engage in transparent communication, and possibly collaborate with the private sector to enhance returns. Through careful planning, education, and strategic management, the UPS has the potential to redefine social security in India, securing the financial future of millions of government employees.

The introduction of the UPS has been lauded as a landmark decision that will ensure a dignified and secure future for lakhs of government employees following their dedicated service. The UPS addresses the uncertainties faced by employees under the NPS, guaranteeing a pension for those who have completed a minimum of 25 years of service. For individuals with service tenure between 10 and 25 years, a proportionate pension will be provided.

Furthermore, the UPS ensures financial security for families in the event of an employee’s untimely death during service, as their family will receive 60% of the pension as a family pension. Additionally, the government will contribute 18.5% of the employee’s basic salary towards their pension, with an assured minimum pension of Rs 10,000 per month for retirees with at least 10 years of service. These provisions are vital in safeguarding the economic well-being of employees and their families.

In addition to the assured pension, family pension, and minimum pension, the scheme will be adjusted according to inflation, providing protection against the rising cost of living. This adjustment is crucial, as it ensures that pensioners maintain their purchasing power over time, mitigating the impact of inflation on their quality of life.

Additionally, the scheme’s sustainability will hinge on its successful implementation and the government’s ability to manage its financial implications. If implemented effectively, the UPS could serve as a model for other sectors, encouraging broader adoption of similar pension schemes.

The introduction of the Unified Pension Scheme marks a significant milestone in India’s approach to securing the future of its government employees. By balancing elements of the Old Pension Scheme and the National Pension System, the UPS addresses long-standing concerns about pension security while ensuring fiscal responsibility. However, its success will depend on the government’s ability to manage pension funds effectively, engage in transparent communication, and possibly collaborate with the private sector to enhance returns. Through careful planning, education, and strategic management, the UPS has the potential to redefine social security in India, securing the financial future of millions of government employees. As the country navigates the complexities of pension reform, it is crucial that the government remains committed to safeguarding the interests of its workforce and building a robust, sustainable social security system that instills confidence in the hearts of those who have dedicated their careers to public service.

visit arjasrikanth.in for more insights