Balancing Social Security and Financial Benefits: The Case for a Hybrid Pension Scheme

As of July 2024, the Government of India has decisively turned away from proposals to reinstate the Old Pension Scheme (OPS) for central government employees hired after January 1, 2004. Instead, the focus is on enhancing the National Pension System (NPS), highlighting the government’s commitment to fiscal responsibility while addressing the need for retirement security among government employees. This strategic shift affects over 3.5 million central government employees and more than 0.7 million pensioners, underscoring the importance of balancing financial sustainability with social welfare in the nation’s pension policies.

The OPS provided a guaranteed lifelong income post-retirement, calculated as 50% of the last drawn basic salary plus dearness allowance (DA) or the average earnings of the last ten months of service, whichever was higher. The scheme was unfunded, meaning pensions were paid out of current revenues, which posed a significant fiscal burden on the government.

The guaranteed income and minimal risk associated with the OPS made it a preferred choice for many employees. However, its unfunded nature meant that the government had to allocate substantial resources from its current revenues to meet pension obligations, potentially straining the fiscal budget and diverting funds from other developmental and welfare programs.

The National Pension System (NPS)Introduced in 2004, the NPS marked a significant departure from the OPS. It is a defined contribution scheme where both the employee and the employer contribute towards the pension fund. These funds are invested in various financial instruments, with returns being market-linked, making the pay-out at retirement uncertain. This system encourages long-term savings and investments, aligning with broader economic reforms aimed at fiscal prudence.

The NPS offers several advantages, including tax deductions of up to ₹1.5 lakh under Section 80C of the Income Tax Act, along with additional deductions under Section 80CCD(1B). It encourages long-term savings and investments, allowing employees to allocate their contributions to different financial instruments and potentially earn higher returns. Additionally, the NPS provides flexibility in choosing the investment mix, enabling employees to tailor their investments according to their risk appetite and financial goals.

However, the NPS also comes with its challenges. The major issue is that it is market-linked and return-based, making the payout uncertain. At maturity, employees can withdraw 60% of the accumulated corpus tax-free, while the remaining 40%, received as an annuity, is taxable. This market exposure can create anxiety among employees regarding their post-retirement financial stability.

In March 2023, the government set up a committee led by Finance Secretary T V Somanathan to explore how to enhance the NPS without reverting to the OPS. The committee’s proposal integrates elements of both NPS and OPS, aiming to provide a hybrid solution that balances fiscal responsibility with adequate retirement security.

The proposed hybrid model includes a provision for a 50% assured pension for central government staff under the NPS. This approach seeks to provide a safety net similar to the OPS while maintaining the investment and savings discipline of the NPS. By offering a guaranteed component within the NPS framework, the proposal aims to provide a sense of security to employees while encouraging them to save and invest for their future.

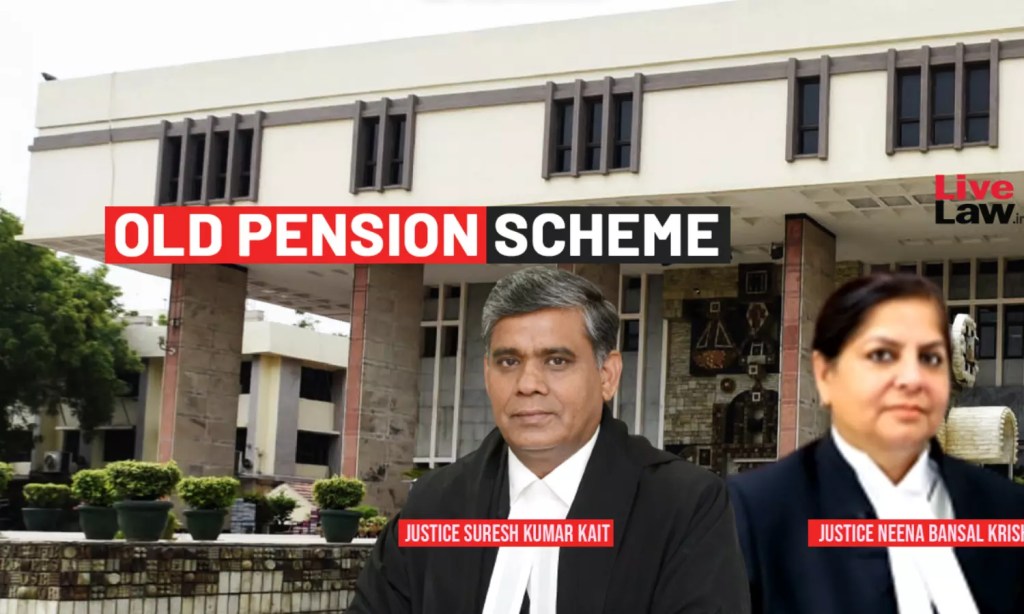

Despite these efforts, there remains a strong demand from various quarters, including employees’ unions, to revert to the OPS. The Supreme Court of India has also played a role in this discourse. In a landmark judgment, the Supreme Court upheld the Delhi High Court’s directive to restore the OPS for certain central government employees. This judgment has added fuel to the ongoing debate and has led to increased pressure on the government to reconsider its stance on the OPS.

Several state governments have already reintroduced the OPS for their employees, fulfilling election promises and responding to public demand. States like Himachal Pradesh, Chhattisgarh, Rajasthan, Jharkhand, and Punjab have reinstated the OPS, which has further intensified the call for its revival at the central level.

The government’s current approach of enhancing the NPS while incorporating elements of the OPS aims to strike a balance between providing adequate retirement benefits and maintaining fiscal responsibility. Several enhancements to the NPS have been made to make it more attractive. For instance, the contribution rates for both the government and employees have been increased to 14% each. This increase aims to ensure a larger corpus at the time of retirement, providing better financial security.

Additionally, the NPS offers flexibility in choosing the investment mix, allowing employees to tailor their investments according to their risk appetite and financial goals. Another significant development is the enhancement of Dearness Relief (DR) for central government pensioners. Effective from January 2024, the DR has been increased from 46% to 50% of the basic pension/family pension, including additional pension/family pension. This increase is aimed at helping pensioners cope with inflation and rising living costs.

The government has also introduced new rules for pension schemes to provide better clarity and structure. For instance, in cases where government servants leave the scheme before attaining the age of 60, the mandatory annuitisation would be 80% of the pension wealth. This ensures that a substantial portion of the pension wealth is used to provide a regular income stream in retirement.

The Supreme Court has also ruled on higher pension schemes, enabling subscribers to opt for higher pensions. This ruling, while offering the potential for better retirement benefits, emphasizes the need for careful retirement planning and consideration of tax implications.

The debate over which pension scheme is better—OPS or NPS—continues to be a complex one. The OPS offers guaranteed income and minimal risk, making it a preferred choice for many employees. However, it poses significant fiscal challenges. The NPS, while providing tax benefits and encouraging long-term savings, exposes employees to market risks and uncertain returns.

Employees must weigh the advantages and disadvantages of both schemes before making a decision. The guaranteed income and minimal risk of the OPS offer security but come with fiscal sustainability challenges. On the other hand, the NPS, with its tax benefits and potential for higher returns, requires careful financial planning and risk management.

In conclusion, the Government of India’s decision to enhance the National Pension System (NPS) rather than revert to the Old Pension Scheme (OPS) for central government employees recruited after January 1, 2004, reflects a balanced approach to addressing employees’ concerns while maintaining fiscal discipline. The committee’s proposal to integrate elements of both schemes aims to create a hybrid solution that ensures financial security for employees while promoting savings and investment discipline. This strategic shift affects over 3.5 million central government employees and more than 0.7 million pensioners, underscoring the importance of balancing financial sustainability with social welfare in the nation’s pension policies.

The debate highlights the merits and challenges of both schemes. The OPS provides predictable and secure retirement benefits, but its unfunded nature imposes significant fiscal burdens. Conversely, the NPS encourages long-term savings and offers tax benefits, but it exposes employees to market risks and uncertain returns. Ultimately, the choice between OPS and NPS depends on individual preferences, financial goals, and risk tolerance. The government’s efforts to enhance the NPS and provide a guaranteed pension component underscore its commitment to the financial well-being of its employees while maintaining fiscal responsibility. By leveraging the expertise of financial experts and ensuring a minimum guarantee for employees, a hybrid pension scheme can address concerns of social security and financial benefits, promoting the well-being of employees, generating revenue for developmental purposes, and ensuring optimal utilization of pension funds in the financial markets.

visit arjasrikanth.in for more insights