The collapse of FTX and the subsequent legal battle have reshaped the landscape of the cryptocurrency industry, highlighting the need for stricter regulations and investor protection.

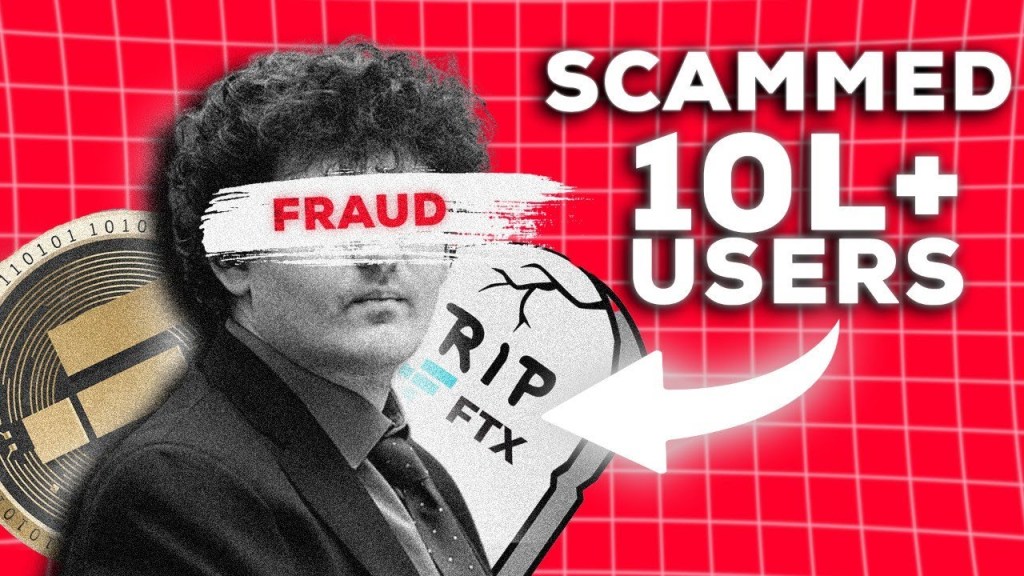

In November 2022, the collapse of FTX, a prominent cryptocurrency exchange, stunned the digital currency world. Lasting for 10 days, this catastrophic event sent shockwaves throughout the industry, revealing a complex web of fraud and deceit orchestrated by FTX’s founder, Sam Bankman-Fried. As the fallout continues, the case against Mr. Bankman-Fried sheds light on the pressing need for enhanced regulatory oversight and accountability within the cryptocurrency market.

The case against Mr. Bankman-Fried revolves around the operation of FTX, where customers deposited funds to trade cryptocurrencies. However, it was later discovered that FTX had misappropriated customer funds to support other ventures, leading to the exchange’s collapse. The exposure of FTX’s balance sheet raised questions about the relationship between FTX, its affiliated companies, and Alameda Research, ultimately uncovering a massive fraud conspiracy.

The FTX fraud case brought to light several controversies and legal challenges, including breaches of data privacy and allegations of inappropriate access to user data by FTX employees. Moreover, geopolitical tensions, exemplified by India’s ban on Chinese-owned platforms, underscored the broader implications of the case and the need for stricter regulations. These issues highlighted the importance of safeguarding investor interests and national security in the cryptocurrency space.

Beyond the United States, the fallout from the FTX collapse reverberated globally, prompting governments worldwide to take action against the exchange. The decline in confidence in the crypto market, coupled with regulatory scrutiny, posed significant challenges for the industry. Rebuilding trust among investors and ensuring regulatory compliance became paramount as the cryptocurrency market faced increased scrutiny and scepticism.

As Mr. Bankman-Fried sentenced 25 years of imprisonment recently by American Court, the potential consequences of his actions loom large. However, efforts to recover lost funds have made significant progress, with FTX reclaiming a substantial portion of the missing assets. Despite these efforts, the impact on investor confidence and the broader cryptocurrency industry remains profound.

The collapse of FTX and the subsequent legal battle represent a watershed moment in American financial history. The case serves as a stark reminder of the risks inherent in the cryptocurrency market and the urgent need for enhanced regulatory oversight. Moving forward, stricter regulations and compliance measures will be crucial to restoring trust and ensuring the long-term viability of the cryptocurrency industry. As investors and regulators grapple with the fallout from the FTX fraud case, the lessons learned will shape the future trajectory of digital currency markets, paving the way for a more secure and transparent ecosystem.

visit arjasrikanth.in for more insights